Page 54 - DCOM202_COST_ACCOUNTING_I

P. 54

Cost Accounting – I

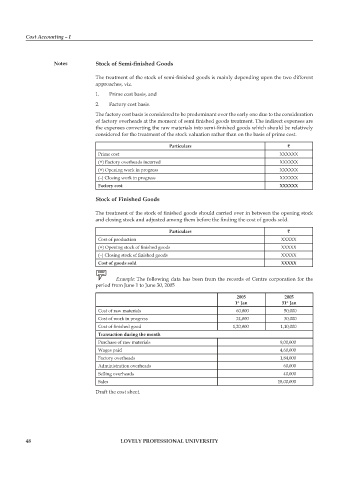

Notes Stock of Semi-finished Goods

The treatment of the stock of semi-finished goods is mainly depending upon the two different

approaches, viz.

1. prime cost basis, and

2. Factory cost basis.

The factory cost basis is considered to be predominant over the early one due to the consideration

of factory overheads at the moment of semi finished goods treatment. The indirect expenses are

the expenses converting the raw materials into semi-finished goods which should be relatively

considered for the treatment of the stock valuation rather than on the basis of prime cost.

Particulars `

prime cost XXXXXX

(+) Factory overheads incurred XXXXXX

(+) Opening work in progress XXXXXX

(–) Closing work in progress XXXXXX

Factory cost XXXXXX

Stock of Finished Goods

The treatment of the stock of finished goods should carried over in between the opening stock

and closing stock and adjusted among them before the finding the cost of goods sold.

Particulars `

Cost of production XXXXX

(+) Opening stock of finished goods XXXXX

(–) Closing stock of finished goods XXXXX

Cost of goods sold XXXXX

Example: The following data has been from the records of Centre corporation for the

period from June 1 to June 30, 2005

2005 2005

1 Jan 31 Jan

st

st

Cost of raw materials 60,000 50,000

Cost of work in progress 24,000 30,000

Cost of finished good 1,20,000 1,10,000

Transaction during the month

purchase of raw materials 9,00,000

Wages paid 4,60,000

Factory overheads 1,84,000

Administration overheads 60,000

Selling overheads 40,000

Sales 18,00,000

Draft the cost sheet.

48 LOVELY PROFESSIONAL UNIVERSITY