Page 53 - DCOM202_COST_ACCOUNTING_I

P. 53

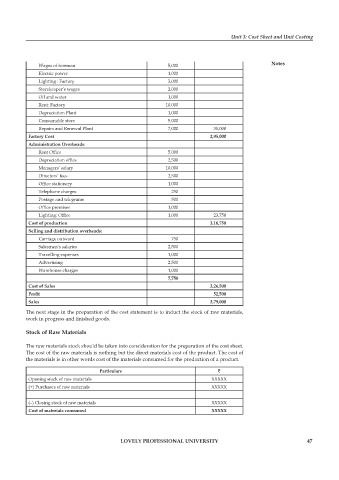

Unit 3: Cost Sheet and Unit Costing

Wages of foreman 5,000 Notes

Electric power 1,000

Lighting : Factory 3,000

Storekeeper’s wages 2,000

Oil and water 1,000

Rent: Factory 10,000

Depreciation plant 1,000

Consumable store 5,000

Repairs and Renewal plant 7,000 35,000

Factory Cost 2,95,000

Administration Overheads:

Rent Office 5,000

Depreciation office 2,500

Managers’ salary 10,000

Directors’ fees 2,500

Office stationery 1,000

Telephone charges 250

postage and telegrams 500

Office premises 1,000

Lighting: Office 1,000 23,750

Cost of production 3,18,750

Selling and distribution overheads:

Carriage outward 750

Salesmen’s salaries 2,500

Travelling expenses 1,000

Advertising 2,500

Warehouse charges 1,000

7,750

Cost of Sales 3,26,500

Profit 52,500

Sales 3,79,000

The next stage in the preparation of the cost statement is to induct the stock of raw materials,

work in progress and finished goods.

Stock of Raw Materials

The raw materials stock should be taken into consideration for the preparation of the cost sheet.

The cost of the raw materials is nothing but the direct materials cost of the product. The cost of

the materials is in other words cost of the materials consumed for the production of a product.

Particulars `

Opening stock of raw materials XXXXX

(+) purchases of raw materials XXXXX

(–) Closing stock of raw materials XXXXX

Cost of materials consumed XXXXX

LOVELY PROFESSIONAL UNIVERSITY 47