Page 104 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 104

Unit 5: Internal Reconstruction of Companies

Shares of ` 90 each fully paid up 10,80,000 (` 7,20,000 – ` 2,40,000) 4,80,000 notes

16,000 Equity Shares of ` 10 each 1,60,000 Machinery

1,920 Equity Shares of ` 5 each 9,600 (` 14,40,000 – ` 4,80,000) 9,60,000

Secured Loans: Current Assets:

6% Debentures 4,00,000 Stock 1,20,000

Current Liabilities: Debtors 2,49,600

Creditors 1,60,000

18,09,600 18,09,600

Illustration 11

XYZ Industries Ltd. whose Balance Sheet as on 31 March, 2006 appears below, formulated a

st

scheme of reconstruction, details of which follows and sacred approval of all concerned:

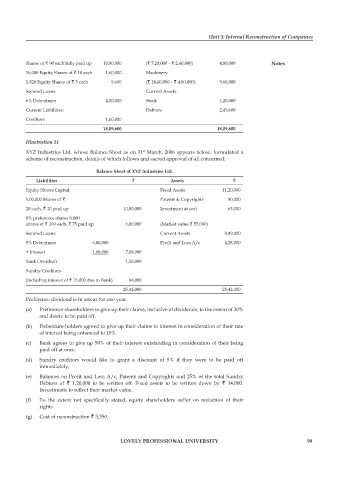

Balance sheet of xyZ industries ltd.

liabilities ` assets `

Equity Shares Capital: Fixed Assets 11,20,000

1,00,000 Shares of ` Patents & Copyrights 80,000

20 each, ` 10 paid up 10,00,000 Investment at cost 65,000

8% preference shares 8,000

shares of ` 100 each, ` 75 paid up 6,00,000 (Market value ` 55,000)

Secured Loans: Current Assets 8,49,000

9% Debentures 6,00,000 Profit and Loss A/c 4,28,000

+ Interest 1,08,000 7,08,000

Bank Overdraft 1,50,000

Sundry Creditors

(including interest of ` 15,000 due to Bank) 84,000

25,42,000 25,42,000

Preference dividend is in arrear for one year.

(a) Preference shareholders to give up their claims, inclusive of dividends, to the extent of 30%

and desire to be paid off.

(b) Debenture-holders agreed to give up their claims to interest in consideration of their rate

of interest being enhanced to 10%.

(c) Bank agrees to give up 50% of their interest outstanding in consideration of their being

paid off at once.

(d) Sundry creditors would like to grant a discount of 5% if they were to be paid off

immediately.

(e) Balances on Profit and Loss A/c, Patents and Copyrights and 25% of the total Sundry

Debtors of ` 1,20,000 to be written off. Fixed assets to be written down by ` 14,000.

Investments to reflect their market value.

(f) To the extent not specifically stated, equity shareholders suffer on reduction of their

rights.

(g) Cost of reconstruction ` 3,350.

lovely professional university 99