Page 102 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 102

Unit 5: Internal Reconstruction of Companies

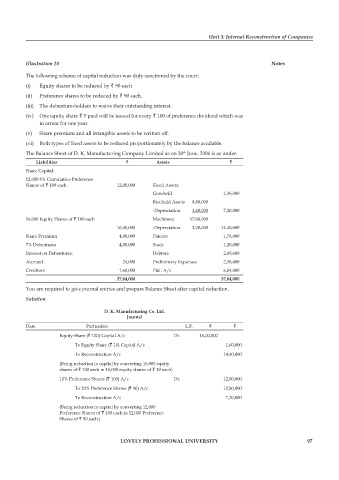

Illustration 10 notes

The following scheme of capital reduction was duly sanctioned by the court:

(i) Equity shares to be reduced by ` 90 each

(ii) Preference shares to be reduced by ` 90 each.

(iii) The debenture-holders to waive their outstanding interest.

(iv) One equity share ` 5 paid will be issued for every ` 100 of preference dividend which was

in arrear for one year.

(v) Share premium and all intangible assets to be written off.

(vi) Both types of fixed assets to be reduced proportionately by the balance available.

The Balance Sheet of D. K. Manufacturing Company Limited as on 30 June, 2006 is as under:

th

liabilities ` assets `

Share Capital:

12,000 8% Cumulative Preference

Shares of ` 100 each. 12,00,000 Fixed Assets:

Goodwill 1,36,000

Freehold Assets 8,80,000

-Depreciation 1,60,000 7,20,000

16,000 Equity Shares of ` 100 each Machinery 17,60,000

16,00,000 -Depreciation 3,20,000 14,40,000

Share Premium 4,00,000 Patents 1,76,000

7% Debentures 4,00,000 Stock 1,20,000

Interest on Debentures: Debtors 2,49,600

Accrued 24,000 Preliminary Expenses 2,58,400

Creditors 1,60,000 P&L A/c 6,84,000

37,84,000 37,84,000

You are required to give journal entries and prepare Balance Sheet after capital reduction.

Solution

D. k. manufacturing co. ltd.

Journal

Date Particulars L.F. ` `

Equity Share (` 100) Capital A/c Dr. 16,00,000

To Equity Share (` 10) Capital A/c 1,60,000

To Reconstruction A/c 14,40,000

(Being reduction in capital by converting 16,000 equity

shares of ` 100 each in 16,000 equity shares of ` 10 each)

10% Preference Shares (` 100) A/c Dr. 12,00,000

To 10% Preference Shares (` 90) A/c 10,80,000

To Reconstruction A/c 1,20,000

(Being reduction in capital by converting 12,000

Preference Shares of ` 100 each in 12,000 Preference

Shares of ` 90 each.)

lovely professional university 97