Page 97 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 97

Accounting for Companies – II

notes To Debtors A/c 1,20,000

To Reconstruction A/c 30,000

(Being reduction in mortgage debentures by transferring the stock

and debtors in full settlement of the claim of debenture-holders and

balance transferred to reconstruction account)

Plant and Machinery A/c Dr. 1,50,000

To Reconstruction A/c 1,50,000

(Being utilization of the amount of capital reduction in the

appreciation of plant and machinery)

Reconstruction A/c Dr. 10,80,000

To Goodwill A/c 45,000

To Freehold Properties A/c 3,00,000

To Profit and Loss A/c 7,35,000

(Being utilization of the balance of capital reduction account in

writing off the fictitious assets and accumulated losses)

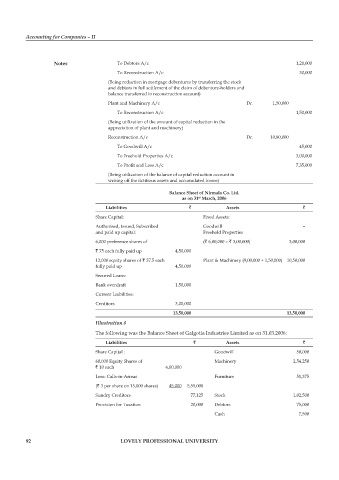

Balance sheet of nirmala co. ltd.

as on 31 march, 2006

st

liabilities ` assets `

Share Capital: Fixed Assets:

Authorised, Issued, Subscribed Goodwill –

and paid up capital: Freehold Properties

6,000 preference shares of (` 6,00,000 – ` 3,00,000) 3,00,000

` 75 each fully paid up 4,50,000

12,000 equity shares of ` 37.5 each Plant & Machinery (9,00,000 + 1,50,000) 10,50,000

fully paid up 4,50,000

Secured Loans:

Bank overdraft 1,50,000

Current Liabilities:

Creditors 3,00,000

13,50,000 13,50,000

Illustration 8

The following was the Balance Sheet of Galgotia Industries Limited as on 31.03.2006:

liabilities ` assets `

Share Capital : Goodwill 50,000

60,000 Equity Shares of Machinery 2,54,250

` 10 each 6,00,000

Less: Calls-in-Arrear Furniture 51,375

(` 3 per share on 15,000 shares) 45,000 5,55,000

Sundry Creditors 77,125 Stock 1,02,500

Provision for Taxation 20,000 Debtors 75,000

Cash 7,500

92 lovely professional university