Page 96 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 96

Unit 5: Internal Reconstruction of Companies

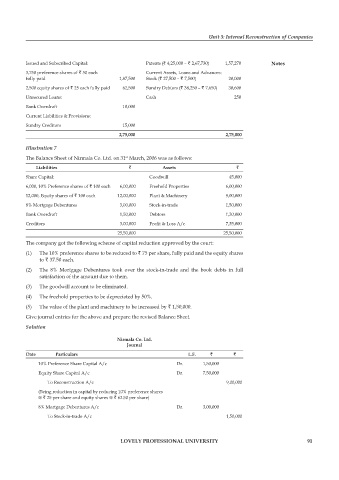

Issued and Subscribed Capital: Patents (` 4,25,000 – ` 2,67,730) 1,57,270 notes

3,750 preference shares of ` 50 each Current Assets, Loans and Advances:

fully paid 1,87,500 Stock (` 27,500 – ` 7,500) 20,000

2,500 equity shares of ` 25 each fully paid 62,500 Sundry Debtors (` 38,250 – ` 7,650) 30,600

Unsecured Loans: Cash 250

Bank Overdraft 10,000

Current Liabilities & Provisions:

Sundry Creditors 15,000

2,75,000 2,75,000

Illustration 7

The Balance Sheet of Nirmala Co. Ltd. on 31 March, 2006 was as follows:

st

liabilities ` assets `

Share Capital: Goodwill 45,000

6,000, 10% Preference shares of ` 100 each 6,00,000 Freehold Properties 6,00,000

12,000, Equity shares of ` 100 each 12,00,000 Plant & Machinery 9,00,000

8% Mortgage Debentures 3,00,000 Stock-in-trade 1,50,000

Bank Overdraft 1,50,000 Debtors 1,20,000

Creditors 3,00,000 Profit & Loss A/c 7,35,000

25,50,000 25,50,000

The company got the following scheme of capital reduction approved by the court:

(1) The 10% preference shares to be reduced to ` 75 per share, fully paid and the equity shares

to ` 37.50 each.

(2) The 8% Mortgage Debentures took over the stock-in-trade and the book debts in full

satisfaction of the amount due to them.

(3) The goodwill account to be eliminated.

(4) The freehold properties to be depreciated by 50%.

(5) The value of the plant and machinery to be increased by ` 1,50,000.

Give journal entries for the above and prepare the revised Balance Sheet.

Solution

nirmala co. ltd.

Journal

Date particulars l.f. ` `

10% Preference Share Capital A/c Dr. 1,50,000

Equity Share Capital A/c Dr. 7,50,000

To Reconstruction A/c 9,00,000

(Being reduction in capital by reducing 10% preference shares

@ ` 25 per share and equity shares @ ` 62.50 per share)

8% Mortgage Debentures A/c Dr. 3,00,000

To Stock-in-trade A/c 1,50,000

lovely professional university 91