Page 99 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 99

Accounting for Companies – II

notes To Profit and Loss Account 1,04,000

To Goodwill Account 50,000

To Preliminary Expenses Account 7,500

(Being writing off the fictitious assets, accumulated losses and

miscellaneous expenses under reconstruction scheme)

Provision for Taxation Account Dr. 1,500

Capital Reserve Account Dr. 75,000

To Capital Reduction Account 76,500

(Being utilization of reserve and provision for taxation for reduction of capital)

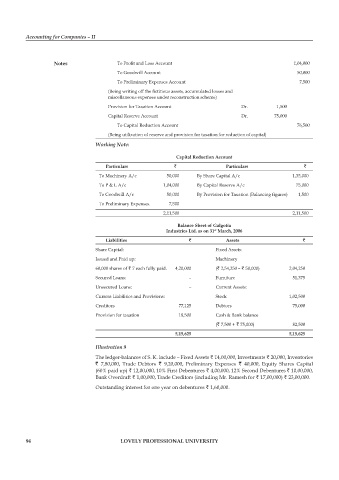

Working Note:

capital reduction account

particulars ` particulars `

To Machinery A/c 50,000 By Share Capital A/c 1,35,000

To P & L A/c 1,04,000 By Capital Reserve A/c 75,000

To Goodwill A/c 50,000 By Provision for Taxation (Balancing figures) 1,500

To Preliminary Expenses. 7,500

2,11,500 2,11,500

Balance sheet of galgotia

industries ltd. as on 31 march, 2006

st

liabilities ` assets `

Share Capital: Fixed Assets:

Issued and Paid up: Machinery

60,000 shares of ` 7 each fully paid. 4,20,000 (` 2,54,250 – ` 50,000) 2,04,250

Secured Loans: – Furniture 51,375

Unsecured Loans: – Current Assets:

Current Liabilities and Provisions: Stock 1,02,500

Creditors 77,125 Debtors 75,000

Provision for taxation 18,500 Cash & Bank balance

(` 7,500 + ` 75,000) 82,500

5,15,625 5,15,625

Illustration 9

The ledger-balances of S. K. include – Fixed Assets ` 14,00,000, Investments ` 20,000, Inventories

` 7,80,000, Trade Debtors ` 9,20,000, Preliminary Expenses ` 40,000, Equity Shares Capital

(60% paid up) ` 12,00,000, 10% First Debentures ` 4,00,000, 12% Second Debentures ` 10,00,000,

Bank Overdraft ` 1,00,000, Trade Creditors (including Mr. Ramesh for ` 17,00,000) ` 23,00,000.

Outstanding interest for one year on debentures ` 1,60,000.

94 lovely professional university