Page 11 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 11

Accounting for Companies – II

notes 6. When amount of goodwill is adjusted with capital reserve because both are not shown in

the balance sheet:

Capital Reserve Account Dr.

To Goodwill Account (amount adjusted)

Notes If the purchase consideration is more than the net assets, excess should be

treated as goodwill.

self assessment

State whether the following statements are true or false:

6. On the purchase of business, the excess of purchase consideration over the net assets

acquired is called goodwill.

7. On the acquisition of a business of a firm by a corporate body, the purchasing company

must open the new books of accounts.

8. After the sale of business, if the partners of the firm want to receive the dividend from the

new company in their old profit-sharing ratio, they must share the equity shares in their

capital ratio.

9. If the same set of books of the vendor is continued, assets and liabilities not taken over by

the purchasing company must be shared by the partners in their final claim ratio.

10. The payment of realisation expenses is made either by vendor or by purchasing company.

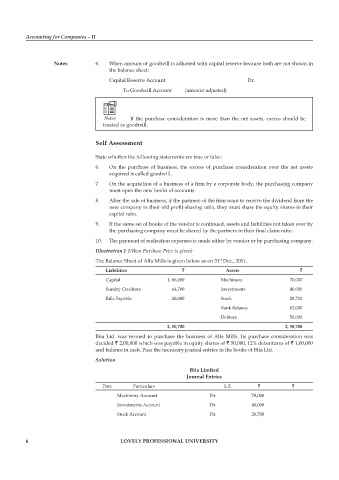

Illustration 1 (When Purchase Price is given)

The Balance Sheet of Alfa Mills is given below as on 31 Dec., 2011.

st

liabilities ` assets `

Capital 1, 66,000 Machinery 70,000

Sundry Creditors 64,700 Investments 40,000

Bills Payable 20,000 Stock 28,700

Bank Balance 62,000

Debtors 50,000

2, 50,700 2, 50,700

Bita Ltd. was formed to purchase the business of Alfa Mills. Its purchase consideration was

decided ` 2,00,000 which was payable in equity shares of ` 50,000, 12% debentures of ` 1,00,000

and balance in cash. Pass the necessary journal entries in the books of Bita Ltd.

Solution

Bita limited

Journal entries

Date Particulars L.F. ` `

Machinery Account Dr. 70,000

Investments Account Dr. 40,000

Stock Account Dr. 28,700

6 lovely professional university