Page 12 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 12

Unit 1: Acquisition of Business

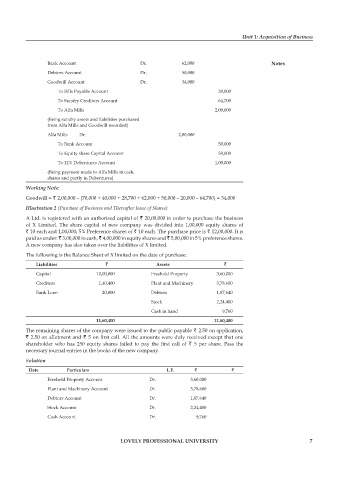

Bank Account Dr. 62,000 notes

Debtors Account Dr. 50,000

Goodwill Account Dr. 34,000

To Bills Payable Account 20,000

To Sundry Creditors Account 64,700

To Alfa Mills 2,00,000

(Being sundry assets and liabilities purchased

from Alfa Mills and Goodwill recorded)

Alfa Mills Dr. 2,00,000

To Bank Account 50,000

To Equity share Capital Account 50,000

To 12% Debentures Account 1,00,000

(Being payment made to Alfa Mills in cash,

shares and partly in Debentures)

Working Note:

Goodwill = ` 2,00,000 – (70,000 + 40,000 + 28,700 + 62,000 + 50,000 – 20,000 – 64,700) = 34,000

Illustration 2 (Purchase of Business and Thereafter Issue of Shares)

A Ltd. is registered with an authorised capital of ` 20,00,000 in order to purchase the business

of X Limited. The share capital of new company was divided into 1,00,000 equity shares of

` 10 each and 1,00,000; 5% Preference shares of ` 10 each. The purchase price is ` 12,00,000. It is

paid as under: ` 3,00,000 in cash, ` 4,00,000 in equity shares and ` 5,00,000 in 5% preference shares.

A new company has also taken over the liabilities of X limited.

The following is the Balance Sheet of X limited on the date of purchase:

liabilities ` assets `

Capital 10,00,000 Freehold Property 3,60,000

Creditors 1,40,400 Plant and Machinery 3,78,600

Bank Loan 20,000 Debtors 1,87,640

Stock 2,24,400

Cash in hand 9,760

11,60,400 11,60,400

The remaining shares of the company were issued to the public payable ` 2.50 on application,

` 2.50 on allotment and ` 5 on first call. All the amounts were duly received except that one

shareholder who has 250 equity shares failed to pay the first call of ` 5 per share. Pass the

necessary journal entries in the books of the new company.

Solution

Date particulars l.f. ` `

Freehold Property Account Dr. 3,60,000

Plant and Machinery Account Dr. 3,78,600

Debtors Account Dr. 1,87,640

Stock Account Dr. 2,24,400

Cash Account Dr. 9,760

lovely professional university 7