Page 142 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 142

Unit 7: Accounting for Banking Companies

notes

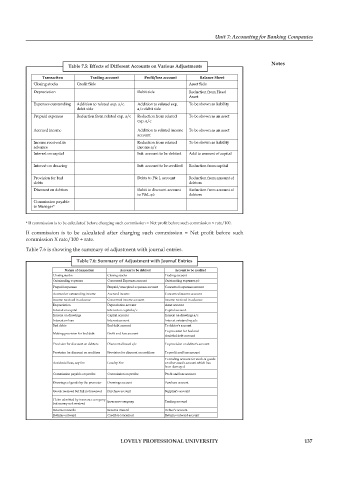

table 7.5: effects of Different accounts on various adjustments

transaction trading account profit/loss account Balance sheet

Closing stocks Credit Side Asset Side

Depreciation Debit side Reduction from Fixed

Asset

Expenses outstanding Addition to related exp. a/c Addition to related exp. To be shown as liability

debit side a/c debit side

Prepaid expenses Reduction from related exp. a/c Reduction from related To be shown as an asset

exp. a/c

Accrued income Addition to related income To be shown as an asset

account

Income received in Reduction from related To be shown as liability

advance income a/c

Interest on capital Intt. account to be debited Add to amount of capital

Interest on drawing Intt. account to be credited Reduction from capital

Provision for bad Debts to P& L account Reduction from amount of

debts debtors

Discount on debtors Debit to discount account Reduction from amount of

to P&L a/c debtors

Commission payable

to Manager*

* If commission is to be calculated before charging such commission = Net profit before such commission × rate/100.

If commission is to be calculated after charging such commission = Net profit before such

commission X rate/100 + rate.

Table 7.6 is showing the summary of adjustment with journal entries.

table 7.6: summary of adjustment with Journal entries

nature of transaction account to be debited account to be credited

Closing stocks Closing stocks Trading account

Outstanding expenses Concerned Expenses account Outstanding expenses a/c

Prepaid expenses Prepaid/unexpired expenses account Concerned expenses account

Accrued or outstanding income Accrued income Concerned income account

Income received in advance Concerned income account Income received in advance

Depreciation Depreciation account Asset account

Interest on capital Interest on capital a/c Capital account

Interest on drawings Capital account Interest on drawings a/c

Interest on loan Interest account Interest outstanding a/c

Bad debts Bad debt account To debtor's account

To provision for bad and

Making provision for bad debt Profit and loss account

doubtful debt account

Provision for discount on debtors Discount allowed a/c To provision on debtor's account

Provision for discount on creditors Provision for discount on creditors To profit and loss account

To trading account for stock of goods

Accidental loss, say fire Loss by Fire or other asset's account which has

been damaged

Commission payable on profits Commission on profits Profit and loss account

Drawings of goods by the promoter Drawings account Purchase account

Goods received but bill not received Purchase account Supplier's account

Claim admitted by insurance company Insurance company Trading account

but money not received

Returns inwards Returns inward Debtor's account

Returns outward Creditor concerned Returns outward account

lovely professional university 137