Page 149 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 149

Accounting for Companies – II

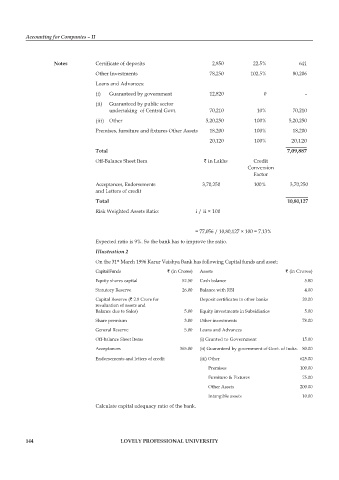

notes Certificate of deposits 2,850 22.5% 641

Other Investments 78,250 102.5% 80,206

Loans and Advances:

(i) Guaranteed by government 12,820 0 -

(ii) Guaranteed by public sector

undertaking of Central Govt. 70,210 10% 70,210

(iii) Other 5,20,250 100% 5,20,250

Premises, furniture and fixtures Other Assets 18,200 100% 18,200

20,120 100% 20,120

total 7,09,887

Off-Balance Sheet Item ` in Lakhs Credit

Conversion

Factor

Acceptances, Endorsements 3,70,250 100% 3,70,250

and Letters of credit

total 10,80,127

Risk Weighted Assets Ratio: i / ii × 100

= 77,056 / 10,80,127 × 100 = 7.13%

Expected ratio is 9%. So the bank has to improve the ratio.

Illustration 2

On the 31 March 1996 Karur Vaishya Bank has following Capital funds and asset:

st

Capital Funds ` (in Crores) Assets ` (in Crores)

Equity shares capital 52.50 Cash balance 5.80

Statutory Reserve 26.00 Balance with RBI 4.00

Capital Reserve (` 2.8 Crore for Deposit certificates in other banks 20.00

revaluation of assets and

Balance due to Sales) 5.00 Equity investments in Subsidiaries 5.00

Share premium 3.00 Other investments 78.00

General Reserve 5.00 Loans and Advances

Off-balance Sheet Items (i) Granted to Government 15.00

Acceptances 365.00 (ii) Guaranteed by government of Govt. of India. 80.00

Endorsements and letters of credit (iii) Other 625.00

Premises 100.00

Furniture & Fixtures 75.00

Other Assets 200.00

Intangible assets 10.00

Calculate capital adequacy ratio of the bank.

144 lovely professional university