Page 152 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 152

Unit 7: Accounting for Banking Companies

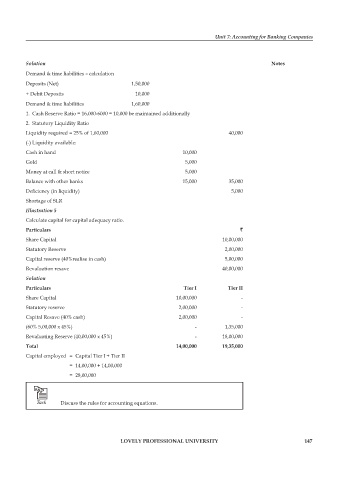

Solution notes

Demand & time liabilities – calculation

Deposits (Net) 1,50,000

+ Debit Deposits 10,000

Demand & time liabilities 1,60,000

1. Cash Reserve Ratio = 16,000-6000 = 10,000 be maintained additionally

2. Statutory Liquidity Ratio

Liquidity required = 25% of 1,60,000 40,000

(-) Liquidity available:

Cash in hand 10,000

Gold 5,000

Money at call & short notice 5,000

Balance with other banks 15,000 35,000

Deficiency (in liquidity) 5,000

Shortage of SLR

Illustration 5

Calculate capital for capital adequacy ratio.

particulars `

Share Capital 10,00,000

Statutory Reserve 2,00,000

Capital reserve (40%realise in cash) 5,00,000

Revaluation resave 40,00,000

Solution

particulars tier i tier ii

Share Capital 10,00,000 -

Statutory reserve 2,00,000 -

Capital Resave (40% cash) 2,00,000 -

(60% 5,00,000 x 45%) - 1,35,000

Revaluating Reserve (40,00,000 x 45%) - 18,00,000

total 14,00,000 19,35,000

Capital employed = Capital Tier I + Tier II

= 14,00,000 + 14,00,000

= 28,00,000

Task Discuss the rules for accounting equations.

lovely professional university 147