Page 150 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 150

Unit 7: Accounting for Banking Companies

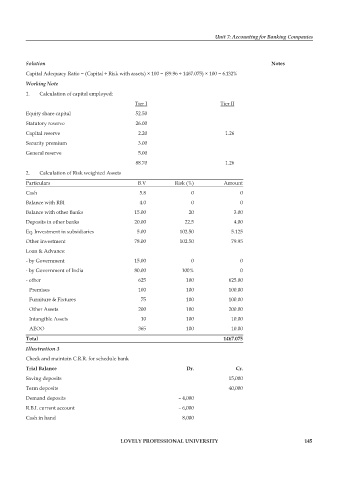

Solution notes

Capital Adequacy Ratio = (Capital ÷ Risk with assets) × 100 = (89.96 ÷ 1467.075) × 100 = 6.132%

Working Note

1. Calculation of capital employed:

Tier I Tier II

Equity share capital 52.50

Statutory reserve 26.00

Capital reserve 2.20 1.26

Security premium 3.00

General reserve 5.00

88.70 1.26

2. Calculation of Risk weighted Assets

Particulars B.V Risk (%) Amount

Cash 5.8 0 0

Balance with RBI 4.0 0 0

Balance with other Banks 15.00 20 3.00

Deposits in other banks 20.00 22.5 4.00

Eq. Investment in subsidiaries 5.00 102.50 5.125

Other investment 78.00 102.50 79.95

Loan & Advance:

- by Government 15.00 0 0

- by Government of India 80.00 100% 0

- other 625 100 625.00

Premises 100 100 100.00

Furniture & Fixtures 75 100 100.00

Other Assets 200 100 200.00

Intangible Assets 10 100 10.00

AEOO 365 100 10.00

total 1467.075

Illustration 3

Check and maintain C.R.R. for schedule bank

trial Balance Dr. cr.

Saving deposits 15,000

Term deposits 40,000

Demand deposits – 4,000

R.B.I. current account – 6,000

Cash in hand 8,000

lovely professional university 145