Page 302 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 302

Unit 13: Valuation of Preference Shares

Notes

Notes It is important to note that the letter of offers and prospectus often refer

to terms like Net Asset Value (NAV), Earning Per Share (EPS), Profit Earnings Ratio

(PE ratio), etc.

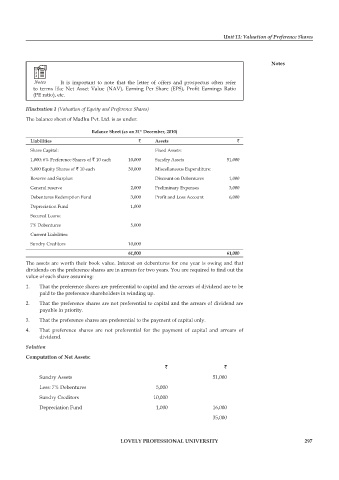

Illustration 1 (Valuation of Equity and Preference Shares)

The balance sheet of Madhu Pvt. Ltd. is as under:

Balance Sheet (as on 31 December, 2010)

st

Liabilities ` Assets `

Share Capital: Fixed Assets:

1,000; 6% Preference Shares of ` 10 each 10,000 Sundry Assets 51,000

3,000 Equity Shares of ` 10 each 30,000 Miscellaneous Expenditure:

Reserve and Surplus: Discount on Debentures 1,000

General reserve 2,000 Preliminary Expenses 3,000

Debentures Redemption Fund 3,000 Profit and Loss Account 6,000

Depreciation Fund 1,000

Secured Loans:

7% Debentures 5,000

Current Liabilities:

Sundry Creditors 10,000

61,000 61,000

The assets are worth their book value. Interest on debentures for one year is owing and that

dividends on the preference shares are in arrears for two years. You are required to find out the

value of each share assuming:

1. That the preference shares are preferential to capital and the arrears of dividend are to be

paid to the preference shareholders in winding up.

2. That the preference shares are not preferential to capital and the arrears of dividend are

payable in priority.

3. That the preference shares are preferential to the payment of capital only.

4. That preference shares are not preferential for the payment of capital and arrears of

dividend.

Solution

Computation of Net Assets:

` `

Sundry Assets 51,000

Less: 7% Debentures 5,000

Sundry Creditors 10,000

Depreciation Fund 1,000 16,000

35,000

LOVELY PROFESSIONAL UNIVERSITY 297