Page 226 - DCOM206_COST_ACCOUNTING_II

P. 226

Unit 12: Standard Costing

2. Labour Variances, Notes

3. Overhead Variances, and

4. Sales Variances.

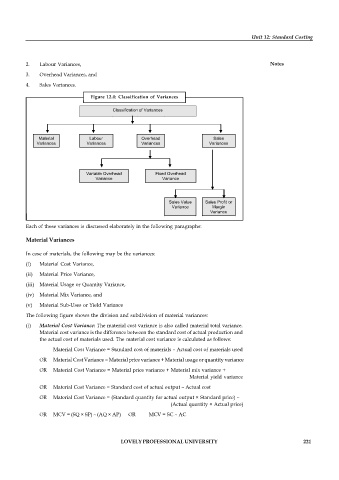

Figure 12.4: Classification of Variances

Classification of Variances

Material Labour Overhead Sales

Variances Variances Variances Variances

Variable Overhead Fixed Overhead

Variance Variance

Sales Value Sales Profit or

Variance Margin

Variance

Each of these variances is discussed elaborately in the following paragraphs:

Material Variances

In case of materials, the following may be the variances:

(i) Material Cost Variance,

(ii) Material Price Variance,

(iii) Material Usage or Quantity Variance,

(iv) Material Mix Variance, and

(v) Material Sub-Uses or Yield Variance

The following figure shows the division and subdivision of material variances:

(i) Material Cost Variance: The material cost variance is also called material total variance.

Material cost variance is the difference between the standard cost of actual production and

the actual cost of materials used. The material cost variance is calculated as follows:

Material Cost Variance = Standard cost of materials – Actual cost of materials used

OR Material Cost Variance = Material price variance + Material usage or quantity variance

OR Material Cost Variance = Material price variance + Material mix variance +

Material yield variance

OR Material Cost Variance = Standard cost of actual output – Actual cost

OR Material Cost Variance = (Standard quantity for actual output × Standard price) –

(Actual quantity × Actual price)

OR MCV = (SQ × SP) – (AQ × AP) OR MCV = SC – AC

LOVELY PROFESSIONAL UNIVERSITY 221