Page 45 - DCOM206_COST_ACCOUNTING_II

P. 45

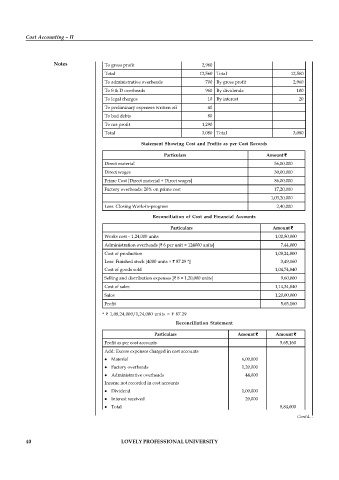

Particulars Amount – ` Particulars Amount – `

To direct materials 5,000 By sales 1,20,000 units 12, 000

Cost Accounting – II

To direct wages 3, 000 By closing stock WIP 240

Finished goods 4800 units 320

To factory overheads 1,600

Notes To gross profit 2,960

Total 12,560 Total 12,560

To administrative overheads 700 By gross profit 2,960

To S & D overheads 960 By dividends 100

To legal charges 10 By interest 20

To preliminary expenses written off 40

To bad debts 80

To net profit 1,290

Total 3,080 Total 3,080

Statement Showing Cost and Profits as per Cost Records

Particulars Amount `

Direct material 56,00,000

Direct wages 30,00,000

Prime Cost [Direct material + Direct wages] 86,00,000

Factory overheads: 20% on prime cost 17,20,000

1,03,20,000

Less: Closing Work-in-progress 2,40,000

Reconciliation of Cost and Financial Accounts

Particulars Amount `

Works cost – 1,24,000 units 1,00,80,000

Administration overheads [` 6 per unit × 124000 units] 7,44,000

Cost of production 1,08,24,000

Less: Finished stock [4000 units × ` 87.29 *] 3,49,160

Cost of goods sold 1,04,74,840

Selling and distribution expenses [` 8 × 1,20,000 units] 9,60,000

Cost of sales 1,14,34,840

Sales 1,20,00,000

Profit 5,65,160

* ` 1,08,24,000/1,24,000 units = ` 87.29

Reconciliation Statement

Particulars Amount ` Amount `

Profit as per cost accounts 5,65,160

Add: Excess expenses charged in cost accounts

Material 6,00,000

Factory overheads 1,20,000

Administrative overheads 44,000

Income not recorded in cost accounts

Dividend 1,00,000

Interest received 20,000

Total 8,84,000

Total 14,49,160 Contd...

Less: Expenses not recorded in cost accounts

Legal charges 10,000

40 Preliminary expenses written off 40,000

LOVELY PROFESSIONAL UNIVERSITY

Bad debts 80,000

Total 1,30,000

Less: Overvaluation of closing stock in cost records 29,160

Total 1,59,160 1,59,160

Profits as per financial accounts 12,90,000