Page 44 - DCOM206_COST_ACCOUNTING_II

P. 44

Particulars ` Particulars `

To Net loss as per cost accounts 3,47,000 By Administration overheads over- 60,000

absorbed

To Factory overheads under-absorbed 40,000 By Interest on investments not 96,000

included in costs

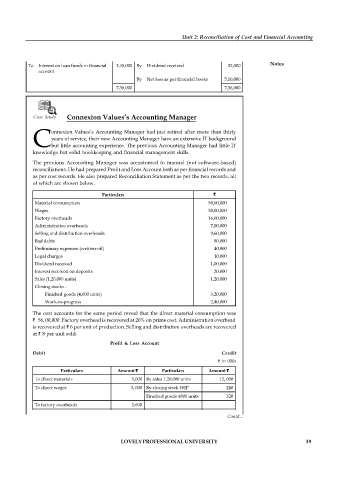

Unit 2: Reconciliation of Cost and Financial Accounting

To Income tax not recorded in cost 54,000 By Transfer fees in financial books 24,000

account

To Depreciation under absorbed in 50,000 By Stores adjustment 14,000

cost account

Notes

To Interest on loan funds in financial 2,45,000 By Dividend received 32,000

account

By Net loss as per financial books 5,10,000

7,36,000 7,36,000

Case Study Connexion Values’s Accounting Manager

onnexion Values’s Accounting Manager had just retired after more than thirty

years of service, their new Accounting Manager have an extensive IT background

Cbut little accounting experience. The previous Accounting Manager had little IT

knowledge but solid bookkeeping and financial management skills.

The previous Accounting Manager was accustomed to manual (not software-based)

reconciliations. He had prepared Profit and Loss Account both as per financial records and

as per cost records. He also prepared Reconciliation Statement as per the two records, all

of which are shown below.

Particulars `

Material consumption 50,00,000

Wages 30,00,000

Factory overheads 16,00,000

Administrative overheads 7,00,000

Selling and distribution overheads 9,60,000

Bad debts 80,000

Preliminary expenses (written-off) 40,000

Legal charges 10,000

Dividend received 1,00,000

Interest received on deposits 20,000

Sales (1,20,000 units) 1,20,000

Closing stocks :

Finished goods (4,000 units) 3,20,000

Work-in-progress 2,40,000

The cost accounts for the same period reveal that the direct material consumption was

` 56, 00,000. Factory overhead is recovered at 20% on prime cost. Administration overhead

is recovered at ` 6 per unit of production. Selling and distribution overheads are recovered

at ` 8 per unit sold.

Profit & Loss Account

Debit Credit

` in 000s

Particulars Amount ` Particulars Amount `

To direct materials 5,000 By sales 1,20,000 units 12, 000

To direct wages 3, 000 By closing stock WIP 240

Finished goods 4800 units 320

To factory overheads 1,600

To gross profit 2,960

Contd...

Total 12,560 Total 12,560

To administrative overheads 700 By gross profit 2,960

To S & D overheads 960 By dividends 100

LOVELY PROFESSIONAL UNIVERSITY 39

To legal charges 10 By interest 20

To preliminary expenses written off 40

To bad debts 80

To net profit 1,290

Total 3,080 Total 3,080