Page 42 - DCOM206_COST_ACCOUNTING_II

P. 42

Unit 2: Reconciliation of Cost and Financial Accounting

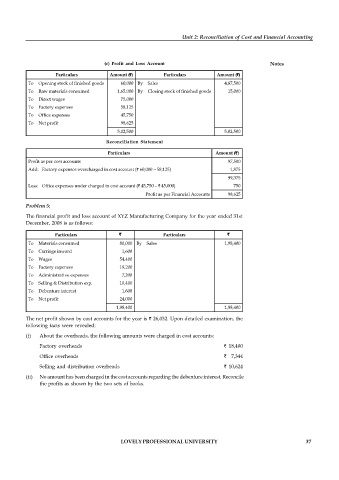

(c) Profit and Loss Account Notes

Particulars Amount (`) Particulars Amount (`)

To Opening stock of finished goods 60,000 By Sales 4,87,500

To Raw materials consumed 1,65,000 By Closing stock of finished goods 15,000

To Direct wages 75,000

To Factory expenses 58,125

To Office expenses 45,750

To Net profit 98,625

5,02,500 5,02,500

Reconciliation Statement

Particulars Amount (`)

Profit as per cost accounts 97,500

Add: Factory expenses overcharged in cost account (` 60,000 – 58,125) 1,875

99,375

Less: Office expenses under charged in cost account (` 45,750 – ` 45,000) 750

Profit as per Financial Accounts 98,625

Problem 5:

The financial profit and loss account of XYZ Manufacturing Company for the year ended 31st

December, 2008 is as follows:

Particulars ` Particulars `

To Materials consumed 80,000 By Sales 1,98,400

To Carriage inward 1,600

To Wages 54,400

To Factory expenses 19,200

To Administrative expenses 7,200

To Selling & Distribution exp. 10,400

To Debenture interest 1,600

To Net profit 24,000

1,98,400 1,98,400

The net profit shown by cost accounts for the year is ` 26,032. Upon detailed examination, the

following facts were revealed:

(i) About the overheads, the following amounts were charged in cost accounts:

Factory overheads ` 18,400

Office overheads ` 7,344

Selling and distribution overheads ` 10,624

(ii) No amount has been charged in the cost accounts regarding the debenture interest. Reconcile

the profits as shown by the two sets of books.

LOVELY PROFESSIONAL UNIVERSITY 37