Page 43 - DCOM206_COST_ACCOUNTING_II

P. 43

Cost Accounting – II

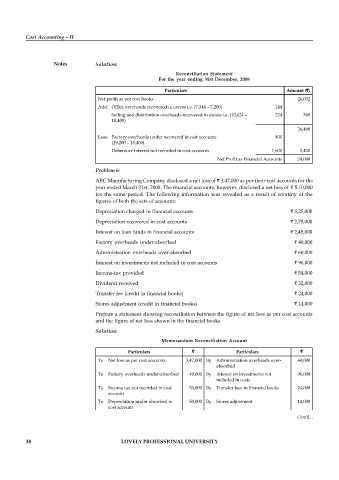

Notes Solution:

Reconciliation Statement

For the year ending 31st December, 2008

Particulars Amount (`)

Net profit as per cost books 26,032

Add: Office overheads recovered in excess i.e. (7,344 – 7,200) 144

Selling and distribution overheads recovered in excess i.e. (10,624 – 224 368

10,400)

26,400

Less: Factory overheads under recovered in cost accounts 800

(19,200 – 18,400)

Debenture interest not recorded in cost accounts 1,600 2,400

Net Profit as Financial Accounts 24,000

Problem 6:

ABC Manufacturing Company disclosed a net loss of ` 3,47,000 as per their cost accounts for the

year ended March 31st, 2008. The financial accounts, however, disclosed a net loss of ` 5,10,000

for the same period. The following information was revealed as a result of scrutiny of the

figures of both the sets of accounts:

Depreciation charged in financial accounts ` 3,25,000

Depreciation recovered in cost accounts ` 2,75,000

Interest on loan funds in financial accounts ` 2,45,000

Factory overheads under-absorbed ` 40,000

Administration overheads over-absorbed ` 60,000

Interest on investments not included in cost accounts ` 96,000

Income-tax provided ` 54,000

Dividend received ` 32,000

Transfer fee (credit in financial books) ` 24,000

Stores adjustment (credit in financial books) ` 14,000

Prepare a statement showing reconciliation between the figure of net loss as per cost accounts

and the figure of net loss shown in the financial books.

Solution:

Memorandum Reconciliation Account

Particulars ` Particulars `

To Net loss as per cost accounts 3,47,000 By Administration overheads over- 60,000

absorbed

To Factory overheads under-absorbed 40,000 By Interest on investments not 96,000

included in costs

To Income tax not recorded in cost 54,000 By Transfer fees in financial books 24,000

account

To Depreciation under absorbed in 50,000 By Stores adjustment 14,000

cost account

32,000

To Interest on loan funds in financial 2,45,000 By Dividend received Contd...

account

By Net loss as per financial books 5,10,000

7,36,000 7,36,000

38 LOVELY PROFESSIONAL UNIVERSITY