Page 39 - DCOM206_COST_ACCOUNTING_II

P. 39

Particulars ` Particulars `

Cost Accounting – II

To Material consumed 12,000 By Sale (350 units) 70,000

To Wages 4,000 By Finished stock (50 units) 3,500

To Factory expenses 12,000 By Interest received 1,500

Notes To Administrative expenses 12,000

To Goodwill written-off 4,000

To Discount of debentures written-off 3,000

To Net profit 28,000

75,000 75,000

The company’s cost records show that:

(a) Factory overheads have been recovered at 100% on prime cost.

(b) Administrative overheads have been recovered at 25% of factory cost.

Prepare:

(a) A statement of cost indicating net profit, and

(b) A statement reconciling the profit as disclosed by cost accounts and that shown in financial

accounts.

Solution:

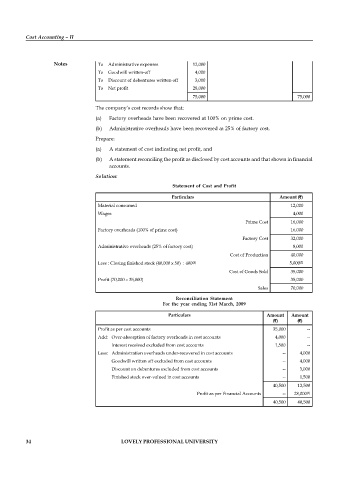

Statement of Cost and Profit

Particulars Amount (`)

Material consumed 12,000

Wages 4,000

Prime Cost 16,000

Factory overheads (100% of prime cost) 16,000

Factory Cost 32,000

Administrative overheads (25% of factory cost) 8,000

Cost of Production 40,000

(1)

(2)

Less : Closing finished stock (40,000 x 50) 400 5,000

Cost of Goods Sold 35,000

Profit (70,000 – 35,000) 35,000

Sales 70,000

Reconciliation Statement

For the year ending 31st March, 2009

Particulars Amount Amount

(`) (`)

Profit as per cost accounts 35,000 --

Add: Over-absorption of factory overheads in cost accounts 4,000 --

Interest received excluded from cost accounts 1,500 --

Less: Administration overheads under-recovered in cost accounts -- 4,000

Goodwill written off excluded from cost accounts -- 4,000

Discount on debentures excluded from cost accounts -- 3,000

Finished stock over-valued in cost accounts -- 1,500

40,500 12,500

(3)

Profit as per Financial Accounts -- 28,000

40,500 40,500

34 LOVELY PROFESSIONAL UNIVERSITY