Page 38 - DCOM206_COST_ACCOUNTING_II

P. 38

Unit 2: Reconciliation of Cost and Financial Accounting

250 machine of X type and 150 machines of Y type were manufactured and sold during the Notes

year ending 31st December 2008 at an average price of ` 2,000 and 2,500 respectively.

Prepare also a profit and loss account for the period in the financial books. The actual

works expenses for X and Y type were ` 47,000 and ` 40,000 respectively, while the actual

office expenses were ` 52,700 and 38,500 respectively. Reconcile profit figures of the two

sets of books.

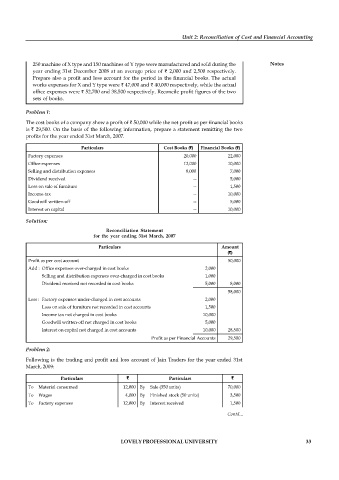

Problem 1:

The cost books of a company show a profit of ` 50,000 while the net profit as per financial books

is ` 29,500. On the basis of the following information, prepare a statement remitting the two

profits for the year ended 31st March, 2007.

Particulars Cost Books (`) Financial Books (`)

Factory expenses 20,000 22,000

Office expenses 12,000 10,000

Selling and distribution expenses 8,000 7,000

Dividend received -- 5,000

Loss on sale of furniture -- 1,500

Income-tax -- 10,000

Goodwill written-off -- 5,000

Interest on capital -- 10,000

Solution:

Reconciliation Statement

for the year ending 31st March, 2007

Particulars Amount

(`)

Profit as per cost account 50,000

Add : Office expenses over-charged in cost books 2,000

Selling and distribution expenses over-charged in cost books 1,000

Dividend received not recorded in cost books 5,000 8,000

58,000

Less : Factory expenses under-charged in cost accounts 2,000

Loss on sale of furniture not recorded in cost accounts 1,500

Income tax not charged in cost books 10,000

Goodwill written-off not charged in cost books 5,000

Interest on capital not charged in cost accounts 10,000 28,500

Profit as per Financial Accounts 29,500

Problem 2:

Following is the trading and profit and loss account of Jain Traders for the year ended 31st

March, 2009:

Particulars ` Particulars `

To Material consumed 12,000 By Sale (350 units) 70,000

To Wages 4,000 By Finished stock (50 units) 3,500

To Factory expenses 12,000 By Interest received 1,500

To Administrative expenses 12,000

Contd...

To Goodwill written-off 4,000

To Discount of debentures written-off 3,000

To Net profit 28,000

LOVELY PROFESSIONAL UNIVERSITY 33

75,000 75,000