Page 41 - DCOM206_COST_ACCOUNTING_II

P. 41

Cost Accounting – II

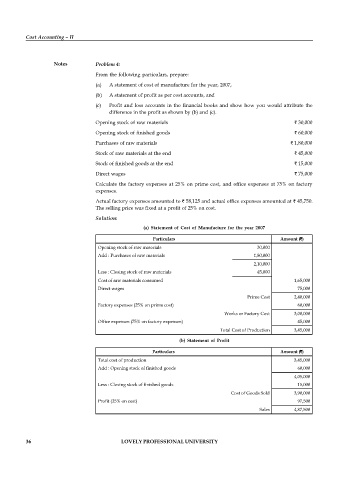

Notes Problem 4:

From the following particulars, prepare:

(a) A statement of cost of manufacture for the year, 2007,

(b) A statement of profit as per cost accounts, and

(c) Profit and loss accounts in the financial books and show how you would attribute the

difference in the profit as shown by (b) and (c).

Opening stock of raw materials ` 30,000

Opening stock of finished goods ` 60,000

Purchases of raw materials ` 1,80,000

Stock of raw materials at the end ` 45,000

Stock of finished goods at the end ` 15,000

Direct wages ` 75,000

Calculate the factory expenses at 25% on prime cost, and office expenses at 75% on factory

expenses.

Actual factory expenses amounted to ` 58,125 and actual office expenses amounted at ` 45,750.

The selling price was fixed at a profit of 25% on cost.

Solution:

(a) Statement of Cost of Manufacture for the year 2007

Particulars Amount (`)

Opening stock of raw materials 30,000

Add : Purchases of raw materials 1,80,000

2,10,000

Less : Closing stock of raw materials 45,000

Cost of raw materials consumed 1,65,000

Direct wages 75,000

Prime Cost 2,40,000

Factory expenses (25% on prime cost) 60,000

Works or Factory Cost 3,00,000

Office expenses (75% on factory expenses) 45,000

Total Cost of Production 3,45,000

(b) Statement of Profit

Particulars Amount (`)

Total cost of production 3,45,000

Add : Opening stock of finished goods 60,000

4,05,000

Less : Closing stock of finished goods 15,000

Cost of Goods Sold 3,90,000

Profit (25% on cost) 97,500

Sales 4,87,500

36 LOVELY PROFESSIONAL UNIVERSITY