Page 30 - DCOM409_CONTEMPORARY_ACCOUNTING

P. 30

Unit 2: Price Level Accounting

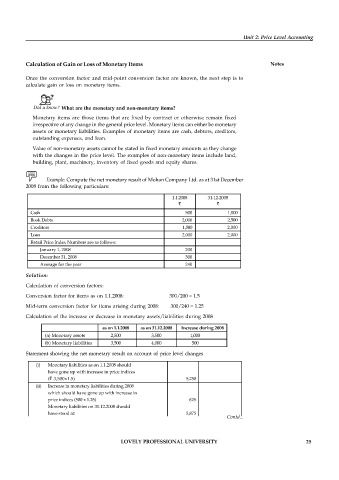

Calculation of Gain or Loss of Monetary Items Notes

Once the conversion factor and mid-point conversion factor are known, the next step is to

calculate gain or loss on monetary items.

Did u know? What are the monetary and non-monetary items?

Monetary items are those items that are fixed by contract or otherwise remain fixed

irrespective of any change in the general price level. Monetary items can either be monetary

assets or monetary liabilities. Examples of monetary items are cash, debtors, creditors,

outstanding expenses, and loan.

Value of non-monetary assets cannot be stated in fixed monetary amounts as they change

with the changes in the price level. The examples of non-monetary items include land,

building, plant, machinery, inventory of fixed goods and equity shares.

Example: Compute the net monetary result of Mohan Company Ltd. as at 31st December

2008 from the following particulars:

1.1.2008 31.12.2008

` `

Cash 500 1,000

Book Debts 2,000 2,500

Creditors 1,500 2,000

Loan 2,000 2,000

Retail Price Index Numbers are as follows:

January 1, 2008 200

December 31, 2008 300

Average for the year 240

Solution:

Calculation of conversion factors:

Conversion factor for items as on 1.1.2008: 300/200 = 1.5

Mid-term conversion factor for items arising during 2008: 300/240 = 1.25

Calculation of the increase or decrease in monetary assets/liabilities during 2008

as on 1.1.2008 as on 31.12.2008 Increase during 2008

(a) Monetary assets 2,500 3,500 1,000

(b) Monetary liabilities 3,500 4,000 500

Statement showing the net monetary result on account of price level changes

(i) Monetary liabilities as on 1.1.2008 should

have gone up with increase in price indices

(` 3,500x1.5) 5,250

(ii) Increase in monetary liabilities during 2008

which should have gone up with increase in

price indices (500 x 1.25) 625

Monetary liabilities on 31.12.2008 should

have stood at: 5,875

Contd...

LOVELY PROFESSIONAL UNIVERSITY 25