Page 35 - DCOM409_CONTEMPORARY_ACCOUNTING

P. 35

Contemporary Accounting

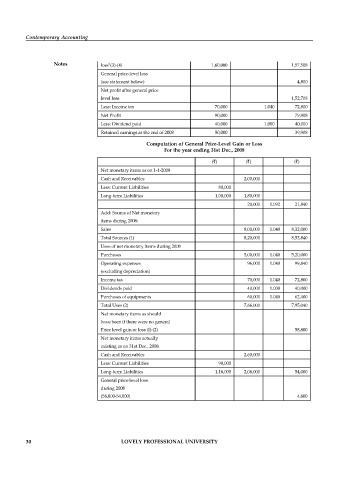

Notes loss"(3)-(4) 1,60,000 1,57,508

General price-level loss

(see statement below) 4,800

Net profit after general price

level loss 1,52,708

Less: Income tax 70,000 1.040 72,800

Net Profit 90,000 79,908

Less: Dividend paid 40,000 1.000 40,000

Retained earnings at the end of 2008 50,000 39,908

Computation of General Price-Level Gain or Loss

For the year ending 31st Dec., 2008

(`) (`) (`)

Net monetary items as on 1-1-2008

Cash and Receivables 2,00,000

Less: Current Liabilities 80,000

Long-term Liabilities 1,00,000 1,80,000

20,000 1.092 21,840

Add: Source of Net monetary

items during 2008:

Sales 8,00,000 1.040 8,32,000

Total Sources (1) 8,20,000 8,53,840

Uses of net monetary items during 2008

Purchases 5,00,000 1.040 5,20,000

Operating expenses 96,000 1.040 99,840

(excluding depreciation)

Income tax 70,000 1.040 72,800

Dividends paid 40,000 1.000 40,000

Purchases of equipments 60,000 1.040 62,400

Total Uses (2) 7,66,000 7,95,040

Net monetary items as should

have been if there were no general

Price level gain or loss (l)-(2) 58,800

Net monetary items actually

existing as on 31st Dec., 2008

Cash and Receivables 2,60,000

Less: Current Liabilities 90,000

Long-term Liabilities 1,16,000 2,06,000 54,000

General price-level loss

during 2008

(58,800-54,000) 4,800

30 LOVELY PROFESSIONAL UNIVERSITY