Page 34 - DCOM409_CONTEMPORARY_ACCOUNTING

P. 34

Unit 2: Price Level Accounting

Sales, purchases, operating expenses (excluding depreciation) took place evenly throughout the Notes

year. Inventories are priced according to first in, first out method. Goods in closing inventories

were acquired evenly throughout the year. The dividend of `40,000 was declared and paid at the

end of 2008. Income tax accrued throughout the year.

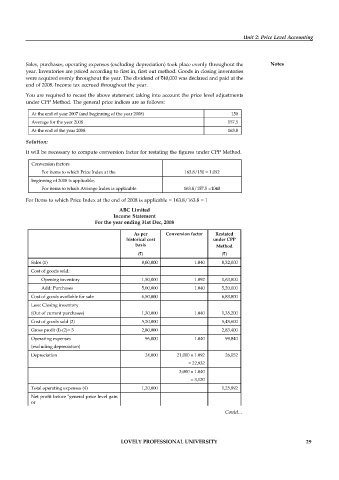

You are required to recast the above statement taking into account the price level adjustments

under CPP Method. The general price indices are as follows:

At the end of year 2007 (and beginning of the year 2008) 150

Average for the year 2008 157.5

At the end of the year 2008 163.8

Solution:

It will be necessary to compute conversion factor for restating the figures under CPP Method.

Conversion factors

For items to which Price Index at the 163.8/150 = 1.092

beginning of 2008 is applicable,

For items to which Average Index is applicable 163.8/157.5 =1040

For Items to which Price Index at the end of 2008 is applicable = 163.8/163.8 = 1

ABC Limited

Income Statement

For the year ending 31st Dec, 2008

As per Conversion factor Restated

historical cost under CPP

basis Method

(`) (`)

Sales (1) 8,00,000 1.040 8,32,000

Cost of goods sold:

Opening inventory 1,50,000 1.092 1,63,800

Add: Purchases 5,00,000 1.040 5,20,000

Cost of goods available for sale 6,50,000 6,83,800

Less: Closing inventory

(Out of current purchases) 1,30,000 1.040 1,35,200

Cost of goods sold (2) 5,20,000 5,48,600

Gross profit (l)-(2)= 3 2,80,000 2,83,400

Operating expenses 96,000 1.040 99,840

(excluding depreciation)

Depreciation 24,000 21,000 × 1.092 26,052

= 22,932

3,000 × 1.040

= 3,120

Total operating expenses (4) 1,20,000 1,25,892

Net profit before "general price level gain

or

Contd...

LOVELY PROFESSIONAL UNIVERSITY 29