Page 36 - DCOM409_CONTEMPORARY_ACCOUNTING

P. 36

Unit 2: Price Level Accounting

Working Notes: Notes

1. Monetary items at the end of 2008 have not been adjusted since they are already standing

at current values at the end of that year.

2. The amount of retained earnings has been taken from the Income Statement as adjusted

according to CPP Method.

3. In the preceding pages, the net profit of the business has been determined by restating all

items in CPP terms. In case it is desired to determine the net profit after tax for the year

2008 according to ‘net change method’, this can be done with the help of comparative

balance sheet restated in CPP terms as shown on page 3.175. Net profit for 2008 will be the

excess of Reserves in 2008 over that in 2007 as stated in CPP terms, as shown below:

`

Assets in CPP terms as on 31-12-2008 7,04,548

Add: Dividends paid on 31-12-91 40,000

7,44,548

Less: Liabilities in CPP terms as on 31-12-2008 6,64,640

Reserves as on 31-12-2008 79,908

Less: Reserves as on 1-12-2008 (Nil)

Net profit for 2008 (after tax but before dividends) 79,908

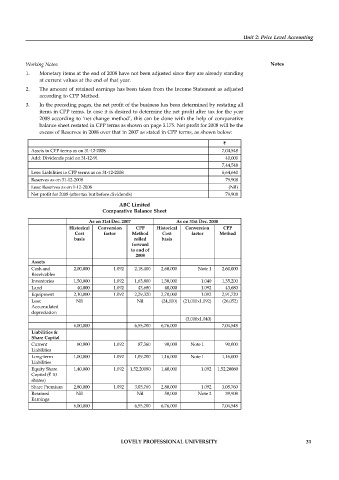

ABC Limited

Comparative Balance Sheet

As on 31st Dec. 2007 As on 31st Dec. 2008

Historical Conversion CPP Historical Conversion CPP

Cost factor Method Cost factor Method

basis rolled basis

forward

to end of

2008

Assets

Cash and 2,00,000 1.092 2,18,400 2,60,000 Note 1 2,60,000

Receivables

Inventories 1,50,000 1.092 1,63,800 1,30,000 1.040 1,35,200

Land 40,000 1.092 43,680 40,000 1.092 43,680

Equipment 2,10,000 1.092 2,29,320 2,70,000 1.092 2,91,720

Less: Nil Nil (24,000) (21,000x1.092) (26,052)

Accumulated

depreciation

(3,000x1.040)

6,00,000 6,55,200 6,76,000 7,04,548

Liabilities &

Share Capital

Current 80,000 1.092 87,360 90,000 Note 1 90,000

Liabilities

Long-term 1,00,000 1.092 1,09,200 1,16,000 Note 1 1,16,000

Liabilities

Equity Share 1,40,000 1.092 1,52,20080 1,40,000 1.092 1,52,20080

Capital (` 10

shares)

Share Premium 2,80,000 1.092 3,05,760 2,80,000 1.092 3,05,760

Retained Nil Nil 50,000 Note 2 39,908

Earnings

6,00,000 6,55,200 6,76,000 7,04,548

LOVELY PROFESSIONAL UNIVERSITY 31