Page 41 - DCOM409_CONTEMPORARY_ACCOUNTING

P. 41

Contemporary Accounting

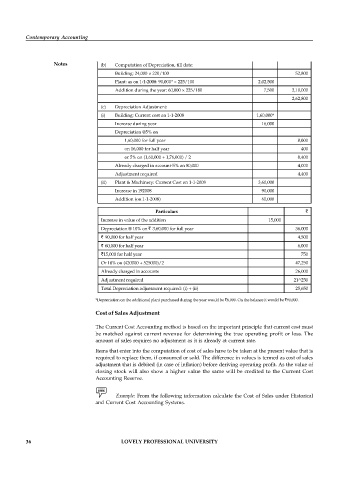

Notes (b) Computation of Depreciation, till date:

Building: 24,000 × 220/100 52,800

Plant: as on 1-1-2008: 90,000* × 225/100 2,02,500

Addition during the year: 60,000 × 225/180 7,500 2,10,000

2,62,800

(c) Depreciation Adjustment:

(i) Building: Current cost on 1-1-2008 1,60,000*

Increase during year 16,000

Depreciation @5% on

1,60,000 for full year 8,000

on 16,000 for half year 400

or 5% on (1,60,000 + 1,76,000) / 2 8,400

Already charged in account-5% on 80,000 4,000

Adjustment required 4,400

(ii) Plant & Machinery: Current Cost on 1-1-2008 3,60,000

Increase in 192008 90,000

Addition (on 1-1-2008) 60,000

Particulars `

Increase in value of the addition 15,000

Depreciation @ 10% on ` 3,60,000 for full year 36,000

` 90,000 for half year 4,500

` 60,000 for half year 6,000

`15,000 for half year 750

Or 10% on (420000 + 525000)/2 47,250

Already charged in accounts 26,000

Adjustment required 21^250

Total Depreciation adjustment required: (i) + (ii) 25,650

*Depreciation on the additional plant purchased during the year would be `6,000. On the balance it would be `90,000.

Cost of Sales Adjustment

The Current Cost Accounting method is based on the important principle that current cost must

be matched against current revenue for determining the true operating profit or loss. The

amount of sales requires no adjustment as it is already at current rate.

Items that enter into the computation of cost of sales have to be taken at the present value that is

required to replace them, if consumed or sold. The difference in values is termed as cost of sales

adjustment that is debited (in case of inflation) before deriving operating profit. As the value of

closing stock will also show a higher value the same will be credited to the Current Cost

Accounting Reserve.

Example: From the following information calculate the Cost of Sales under Historical

and Current Cost Accounting Systems.

36 LOVELY PROFESSIONAL UNIVERSITY