Page 38 - DCOM409_CONTEMPORARY_ACCOUNTING

P. 38

Unit 2: Price Level Accounting

Valuation of Fixed Assets Notes

The fixed assets in the balance sheet are valued at their value to the business, which is defined as

the amount the company will lose if it were deprived of these assets. The value of an asset to the

business could be either of the following:

(a) Replacement Cost Value

(b) Net Realisable Value

(c) Economic Value.

1. Replacement Cost: It refers to the money now required to buy a new asset of the type

similar to the existing asset. The amount of depreciation has also got to be deducted from

the same considering the fact that the true replacement of the asset would not be a new,

asset but an asset that has the same remaining useful life as the existing asset.

Example: Suppose a machine was purchased five years ago with an estimated total

useful life of 10 years for ` 60,000. The value of the machine in the books would stand at ` 30,000,

assuming no scrap value. We further assume the same machine today costs ` 1,00,000 in the

market. The value of this machine now will be shown in the books as ` 50,000 (` 1,00,000 less

depreciation for five years assuming no scrap value).

2. Net realisable value: This is the value which is represented by the net cash proceeds if the

existing asset is sold now.

3. Economic value: It refers to the discounted (present) value of the net income that will be

earned from using the existing assets during the remaining life of the asset. Thus, it is the

net present value of the future anticipated net income that the asset is likely to generate. A

close examination of the asset values discussed above indicates that the replacement cost

value is the purchasing value, net realisable value is the sale value and the economic value

is the holding value.

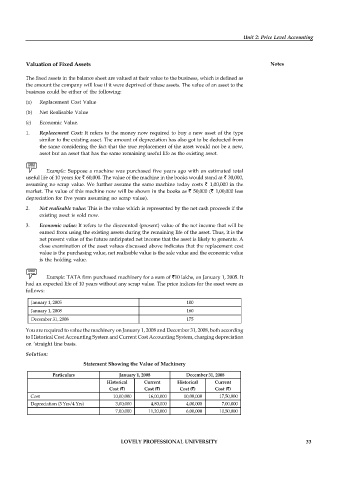

Example: TATA firm purchased machinery for a sum of `10 lakhs, on January 1, 2005. It

had an expected life of 10 years without any scrap value. The price indices for the asset were as

follows:

January 1, 2005 100

January 1, 2008 160

December 31, 2008 175

You are required to value the machinery on January 1, 2008 and December 31, 2008, both according

to Historical Cost Accounting System and Current Cost Accounting System, charging depreciation

on ‘straight line basis.

Solution:

Statement Showing the Value of Machinery

Particulars January 1, 2008 December 31, 2008

Historical Current Historical Current

Cost (`) Cost (`) Cost (`) Cost (`)

Cost 10,00,000 16,00,000 10,00,000 17,50,000

Depreciation (3 Yrs/4 Yrs) 3,00,000 4,80,000 4,00,000 7,00,000

7,00,000 11,20,000 6,00,000 10,50,000

LOVELY PROFESSIONAL UNIVERSITY 33