Page 33 - DCOM409_CONTEMPORARY_ACCOUNTING

P. 33

Contemporary Accounting

Notes

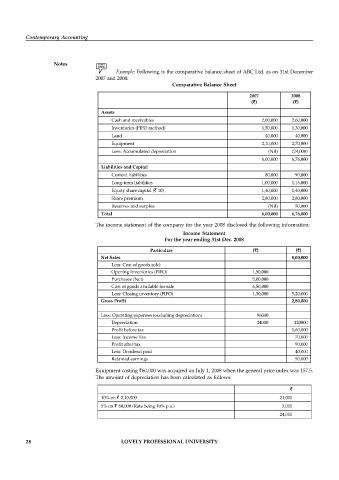

Example: Following is the comparative balance sheet of ABC Ltd. as on 31st December

2007 and 2008:

Comparative Balance Sheet

2007 2008

(`) (`)

Assets

Cash and receivables 2,00,000 2,60,000

Inventories (FIFO method) 1,50,000 1,30,000

Land 40,000 40,000

Equipment 2,10,000 2,70,000

Less: Accumulated depreciation (Nil) (24,000)

6,00,000 6,76,000

Liabilities and Capital

Current liabilities 80,000 90,000

Long-term liabilities 1,00,000 1,16,000

Equity share capital (` 10) 1,40,000 1,40,000

Share premium 2,80,000 2,80,000

Reserves and surplus (Nil) 50,000

Total 6,00,000 6,76,000

The income statement of the company for the year 2008 disclosed the following information:

Income Statement

For the year ending 31st Dec. 2008

Particulars (`) (`)

Net Sales 8,00,000

Less: Cost of goods sold:

Opening Inventories (FIFO) 1,50,000

Purchases (Net) 5,00,000

Cost of goods available for sale 6,50,000

Less: Closing inventory (FIFO) 1,30,000 5,20,000

Gross Profit 2,80,000

Less: Operating expenses (excluding depreciation) 96000

Depreciation 24000 120000

Profit before tax 1,60,000

Less: Income Tax 70,000

Profit after tax 90,000

Less: Dividend paid 40,000

Retained earnings 50,000

Equipment costing `60,000 was acquired on July 1, 2008 when the general price index was 157.5.

The amount of depreciation has been calculated as follows:

`

10% on ` 2,10,000 21,000

5% on ` 60,000 (Rate being 10% p.a.) 3,000

24,000

28 LOVELY PROFESSIONAL UNIVERSITY