Page 193 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 193

Security Analysis and Portfolio Management

Notes

Major Uses of Moving Averages

Did u know?

1. Moving averages are used to identify current trends and trend reversals as well as to

set up support and resistance levels.

2. Moving averages can be used to quickly identify whether a security is moving in an

uptrend or a downtrend depending on the direction of the moving average.

6.8.4 Indicators and Oscillators

Indicators are calculations based on the price and the volume of a security that measure such

things as money flow, trends, volatility and momentum. Indicators are used as a secondary

measure to the actual price movements and add additional information to the analysis of securities.

Indicators are used in two main ways: to confirm price movement and the quality of chart

patterns, and to form buy and sell signals.

There are two main types of indicators: leading and lagging. A leading indicator precedes price

movements, giving them a predictive quality, while a lagging indicator is a confirmation tool

because it follows price movement. A leading indicator is thought to be the strongest during

periods of sideways or non-trending trading ranges, while the lagging indicators are still useful

during trending periods.

Aroon Oscillator

An expansion of the Aroon is the Aroon oscillator, which simply plots the difference between

the Aroon up and down lines by subtracting the two lines. This line is then plotted between a

range of -100 and 100. The centreline at zero in the oscillator is considered to be a major signal

line determining the trend. The higher the value of the oscillator from the centreline point, the

more upward strength there is in the security; the lower the oscillator's value is from the

centreline, the more downward the pressure.

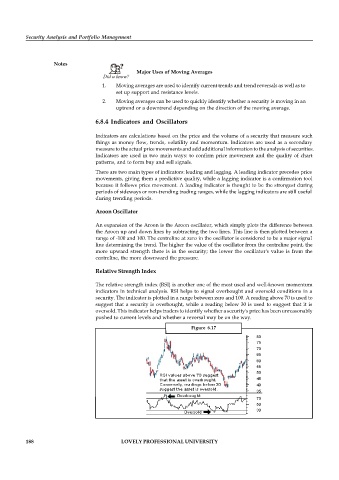

Relative Strength Index

The relative strength index (RSI) is another one of the most used and well-known momentum

indicators in technical analysis. RSI helps to signal overbought and oversold conditions in a

security. The indicator is plotted in a range between zero and 100. A reading above 70 is used to

suggest that a security is overbought, while a reading below 30 is used to suggest that it is

oversold. This indicator helps traders to identify whether a security's price has been unreasonably

pushed to current levels and whether a reversal may be on the way.

Figure 6.17

188 LOVELY PROFESSIONAL UNIVERSITY