Page 190 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 190

Unit 6: Technical Analysis

7. Rounding Bottom: A rounding bottom, also referred to as a saucer bottom, is a long-term Notes

reversal pattern that signals a shift from a downward trend to an upward trend. This

pattern is traditionally thought to last anywhere from several months to several years.

Figure 6.13

A rounding bottom chart pattern looks similar to a cup and handle pattern but without the

handle. The long-term nature of this pattern and the lack of a confirmation trigger, such as

the handle in the cup and handle, make it a difficult pattern to trade.

8. Gaps: A gap in a chart is an empty space between a trading period and the following

trading period. This occurs when there is a large difference in prices between two sequential

trading periods.

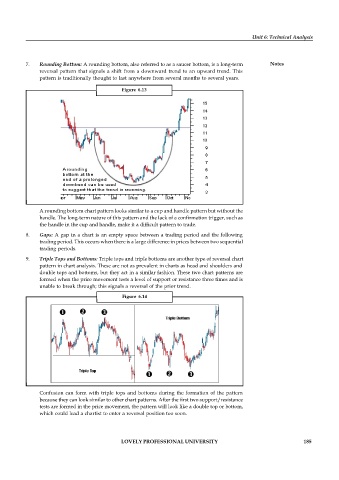

9. Triple Tops and Bottoms: Triple tops and triple bottoms are another type of reversal chart

pattern in chart analysis. These are not as prevalent in charts as head and shoulders and

double tops and bottoms, but they act in a similar fashion. These two chart patterns are

formed when the price movement tests a level of support or resistance three times and is

unable to break through; this signals a reversal of the prior trend.

Figure 6.14

Confusion can form with triple tops and bottoms during the formation of the pattern

because they can look similar to other chart patterns. After the first two support/resistance

tests are formed in the price movement, the pattern will look like a double top or bottom,

which could lead a chartist to enter a reversal position too soon.

LOVELY PROFESSIONAL UNIVERSITY 185