Page 187 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 187

Security Analysis and Portfolio Management

Notes

Figure 6.7

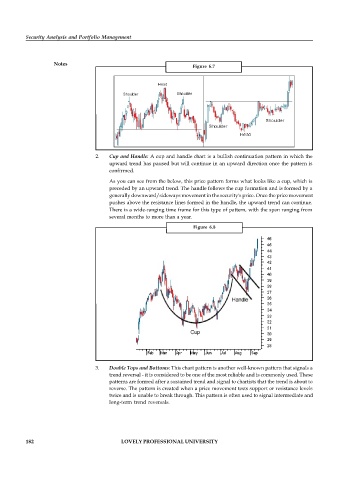

2. Cup and Handle: A cup and handle chart is a bullish continuation pattern in which the

upward trend has paused but will continue in an upward direction once the pattern is

confirmed.

As you can see from the below, this price pattern forms what looks like a cup, which is

preceded by an upward trend. The handle follows the cup formation and is formed by a

generally downward/sideways movement in the security's price. Once the price movement

pushes above the resistance lines formed in the handle, the upward trend can continue.

There is a wide-ranging time frame for this type of pattern, with the span ranging from

several months to more than a year.

Figure 6.8

3. Double Tops and Bottoms: This chart pattern is another well-known pattern that signals a

trend reversal - it is considered to be one of the most reliable and is commonly used. These

patterns are formed after a sustained trend and signal to chartists that the trend is about to

reverse. The pattern is created when a price movement tests support or resistance levels

twice and is unable to break through. This pattern is often used to signal intermediate and

long-term trend reversals.

182 LOVELY PROFESSIONAL UNIVERSITY