Page 189 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 189

Security Analysis and Portfolio Management

Notes

Figure 6.11

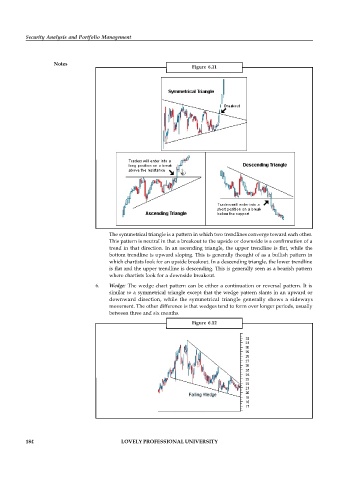

The symmetrical triangle is a pattern in which two trendlines converge toward each other.

This pattern is neutral in that a breakout to the upside or downside is a confirmation of a

trend in that direction. In an ascending triangle, the upper trendline is flat, while the

bottom trendline is upward sloping. This is generally thought of as a bullish pattern in

which chartists look for an upside breakout. In a descending triangle, the lower trendline

is flat and the upper trendline is descending. This is generally seen as a bearish pattern

where chartists look for a downside breakout.

6. Wedge: The wedge chart pattern can be either a continuation or reversal pattern. It is

similar to a symmetrical triangle except that the wedge pattern slants in an upward or

downward direction, while the symmetrical triangle generally shows a sideways

movement. The other difference is that wedges tend to form over longer periods, usually

between three and six months.

Figure 6.12

184 LOVELY PROFESSIONAL UNIVERSITY