Page 188 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 188

Unit 6: Technical Analysis

Notes

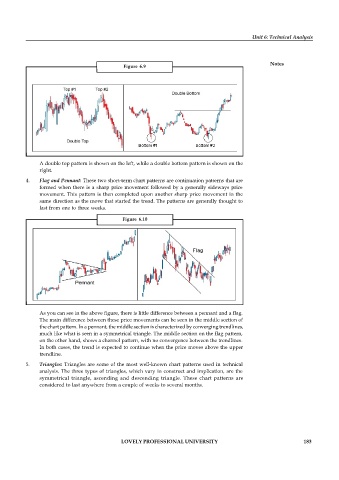

Figure 6.9

A double top pattern is shown on the left, while a double bottom pattern is shown on the

right.

4. Flag and Pennant: These two short-term chart patterns are continuation patterns that are

formed when there is a sharp price movement followed by a generally sideways price

movement. This pattern is then completed upon another sharp price movement in the

same direction as the move that started the trend. The patterns are generally thought to

last from one to three weeks.

Figure 6.10

As you can see in the above figure, there is little difference between a pennant and a flag.

The main difference between these price movements can be seen in the middle section of

the chart pattern. In a pennant, the middle section is characterized by converging trendlines,

much like what is seen in a symmetrical triangle. The middle section on the flag pattern,

on the other hand, shows a channel pattern, with no convergence between the trendlines.

In both cases, the trend is expected to continue when the price moves above the upper

trendline.

5. Triangles: Triangles are some of the most well-known chart patterns used in technical

analysis. The three types of triangles, which vary in construct and implication, are the

symmetrical triangle, ascending and descending triangle. These chart patterns are

considered to last anywhere from a couple of weeks to several months.

LOVELY PROFESSIONAL UNIVERSITY 183