Page 192 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 192

Unit 6: Technical Analysis

For instance, in a five-day linear weighted average, today's closing price is multiplied Notes

by five, yesterday's by four and so on, until the first day in the period range is

reached. These numbers are then added together and divided by the sum of the

multipliers.

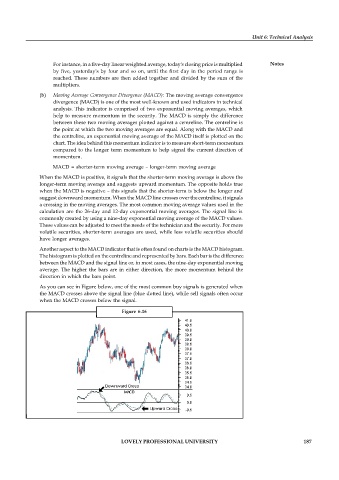

(b) Moving Average Convergence Divergence (MACD): The moving average convergence

divergence (MACD) is one of the most well-known and used indicators in technical

analysis. This indicator is comprised of two exponential moving averages, which

help to measure momentum in the security. The MACD is simply the difference

between these two moving averages plotted against a centreline. The centreline is

the point at which the two moving averages are equal. Along with the MACD and

the centreline, an exponential moving average of the MACD itself is plotted on the

chart. The idea behind this momentum indicator is to measure short-term momentum

compared to the longer term momentum to help signal the current direction of

momentum.

MACD = shorter-term moving average – longer-term moving average

When the MACD is positive, it signals that the shorter-term moving average is above the

longer-term moving average and suggests upward momentum. The opposite holds true

when the MACD is negative – this signals that the shorter-term is below the longer and

suggest downward momentum. When the MACD line crosses over the centreline, it signals

a crossing in the moving averages. The most common moving average values used in the

calculation are the 26-day and 12-day exponential moving averages. The signal line is

commonly created by using a nine-day exponential moving average of the MACD values.

These values can be adjusted to meet the needs of the technician and the security. For more

volatile securities, shorter-term averages are used, while less volatile securities should

have longer averages.

Another aspect to the MACD indicator that is often found on charts is the MACD histogram.

The histogram is plotted on the centreline and represented by bars. Each bar is the difference

between the MACD and the signal line or, in most cases, the nine-day exponential moving

average. The higher the bars are in either direction, the more momentum behind the

direction in which the bars point.

As you can see in Figure below, one of the most common buy signals is generated when

the MACD crosses above the signal line (blue dotted line), while sell signals often occur

when the MACD crosses below the signal.

Figure 6.16

LOVELY PROFESSIONAL UNIVERSITY 187