Page 115 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 115

Working Capital Management

Notes

Case Study Bhatt Enterprises Case: Cash Forecasting and Investing

ushma is the Treasurer of Bhatt Enterprises, a poorly organized collection of financial

services companies. The composition of Bhatt’s activities can best be seen in a

Sstatement of forecasted cash flow by each major business line, namely:

Annual Cash Flow

Insurance policies $ 85,000,000

Insurance underwriting 55,000,000

Assets based lending 200,000,000

Consumer paper 155,000,000

Auto dealer paper 80,000,000

$ 575,000,000

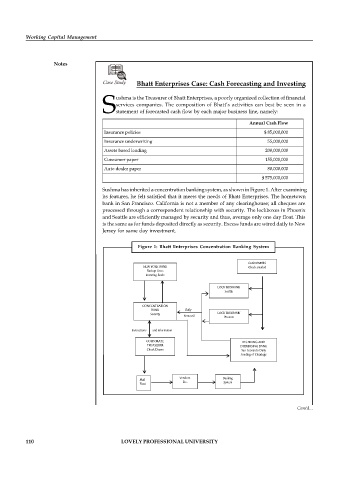

Sushma has inherited a concentration banking system, as shown in Figure 1. After examining

its features, he felt satisfied that it meets the needs of Bhatt Enterprises. The hometown

bank in San Francisco. California is not a member of any clearinghouse; all cheques are

processed through a correspondent relationship with security. The lockboxes in Phoenix

and Seattle are efficiently managed by security and thus, average only one day float. This

is the same as for funds deposited directly as security. Excess funds are wired daily to New

Jersey for same day investment.

Figure 1: Bhatt Enterprises Concentration Banking System

CUSTOMERS

NEW YORK BANK Check smailed

Backup Lines

Investing funds

LOCK BOXBANK

Seattle

CONCENTRATION

Daily

BANK

Security Removal LOCK BOXBANK

Phoenix

Instructions and information

CORPORATE RECEIVING AND

TREASURER DISBURSING BANK

Check Drawn San Leonardo Daily

Funding of Clearings

Mail Vendors. Banking

Float Etc. System

Contd...

110 LOVELY PROFESSIONAL UNIVERSITY