Page 36 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 36

Unit 2: Planning of Working Capital

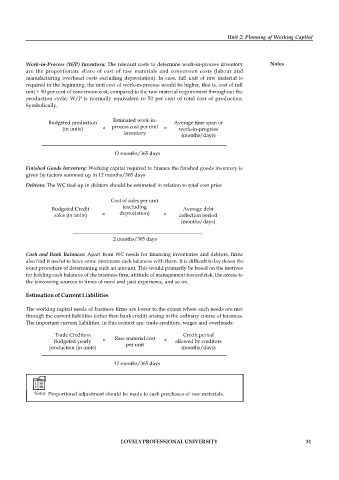

Work-in-Process (W/P) Inventory: The relevant costs to determine work-in-process inventory Notes

are the proportionate share of cost of raw materials and conversion costs (labour and

manufacturing overhead costs excluding depreciation). In case, full unit of raw material is

required in the beginning, the unit cost of work-in-process would be higher, that is, cost of full

unit + 50 per cent of conversion cost, compared to the raw material requirement throughout the

production cycle; W/P is normally equivalent to 50 per cent of total cost of production.

Symbolically,

Estimated work-in-

Budgeted production Average time span or

(in units) × process cost per unit × work-in-progress

inventory

(months/days)

12 months/365 days

Finished Goods Inventory: Working capital required to finance the finished goods inventory is

given by factors summed up in 12 months/365 days

Debtors: The WC tied up in debtors should be estimated in relation to total cost price

Cost of sales per unit

(excluding

Budgeted Credit Average debt

sales (in units) × depreciation) × collection period

(months/days)

2 months/365 days

Cash and Bank Balances: Apart from WC needs for financing inventories and debtors, firms

also find it useful to have some minimum cash balances with them. It is difficult to lay down the

exact procedure of determining such an amount. This would primarily be based on the motives

for holding cash balances of the business firm, attitude of management toward risk, the access to

the borrowing sources in times of need and past experience, and so on.

Estimation of Current Liabilities

The working capital needs of business firms are lower to the extent where such needs are met

through the current liabilities (other than bank credit) arising in the ordinary course of business.

The important current liabilities, in this context are, trade-creditors, wages and overheads:

Trade Creditors Credit period

Budgeted yearly × Raw material cost × allowed by creditors

per unit

production (in units) (months/days)

12 months/365 days

Notes Proportional adjustment should be made to cash purchases of raw materials.

LOVELY PROFESSIONAL UNIVERSITY 31