Page 37 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 37

Working Capital Management

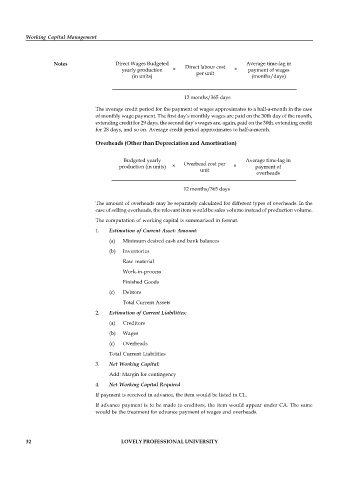

Notes Direct Wages Budgeted Direct labour cost Average time-lag in

yearly production × per unit × payment of wages

(in units) (months/days)

12 months/365 days

The average credit period for the payment of wages approximates to a half-a-month in the case

of monthly wage payment. The first day’s monthly wages are paid on the 30th day of the month,

extending credit for 29 days, the second day’s wages are, again, paid on the 30th, extending credit

for 28 days, and so on. Average credit period approximates to half-a-month.

Overheads (Other than Depreciation and Amortisation)

Budgeted yearly Average time-lag in

production (in units) × Overhead cost per × payment of

unit

overheads

12 months/365 days

The amount of overheads may be separately calculated for different types of overheads. In the

case of selling overheads, the relevant item would be sales volume instead of production volume.

The computation of working capital is summarized in format.

1. Estimation of Current Asset: Amount:

(a) Minimum desired cash and bank balances

(b) Inventories

Raw material

Work-in-process

Finished Goods

(c) Debtors

Total Current Assets

2. Estimation of Current Liabilities:

(a) Creditors

(b) Wages

(c) Overheads

Total Current Liabilities

3. Net Working Capital:

Add: Margin for contingency

4. Net Working Capital Required

If payment is received in advance, the item would be listed in CL.

If advance payment is to be made to creditors, the item would appear under CA. The same

would be the treatment for advance payment of wages and overheads.

32 LOVELY PROFESSIONAL UNIVERSITY