Page 41 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 41

Particulars Amount for the year

Average amount backed up for stocks:

Stocks of finished product 5,000

Stocks of stores and materials 8,000

Working Capital Management Average credit given:

Inland sales, 6 weeks' credit 3,12,000

Export sales, 1.5 weeks' credit 78,000

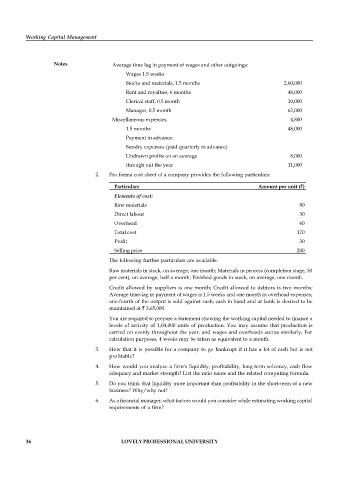

Notes Average time lag in payment of wages and other outgoings:

Wages 1.5 weeks

Stocks and materials, 1.5 months 2,60,000

Rent and royalties, 6 months 48,000

Clerical staff, 0.5 month 10,000

Manager, 0.5 month 62,000

Miscellaneous expenses, 4,800

1.5 months 48,000

Payment in advance:

Sundry expenses (paid quarterly in advance)

Undrawn profits on an average 8,000

through out the year 11,000

2. Pro forma cost sheet of a company provides the following particulars:

Particulars Amount per unit (`)

Elements of cost:

Raw materials 80

Direct labour 30

Overhead 60

Total cost 170

Profit 30

Selling price 200

The following further particulars are available:

Raw materials in stock, on average, one month; Materials in process (completion stage, 50

per cent), on average, half a month; Finished goods in stock, on average, one month.

Credit allowed by suppliers is one month; Credit allowed to debtors is two months;

Average time-lag in payment of wages is 1.5 weeks and one month in overhead expenses;

one-fourth of the output is sold against cash; cash in hand and at bank is desired to be

maintained at ` 3,65,000.

You are required to prepare a statement showing the working capital needed to finance a

levels of activity of 1,04,000 units of production. You may assume that production is

carried on evenly throughout the year, and wages and overheads accrue similarly. For

calculation purposes, 4 weeks may be taken as equivalent to a month.

3. How that it is possible for a company to go bankrupt if it has a lot of cash but is not

profitable?

4. How would you analyze a firm’s liquidity, profitability, long-term solvency, cash flow

adequacy and market strength? List the ratio name and the related computing formula.

5. Do you think that liquidity more important than profitability in the short-term of a new

business? Why/why not?

6. As a financial manager, what factors would you consider while estimating working capital

requirements of a firm?

36 LOVELY PROFESSIONAL UNIVERSITY