Page 160 - DMGT104_FINANCIAL_ACCOUNTING

P. 160

Financial Accounting

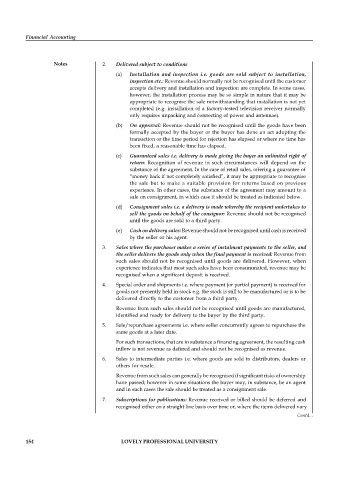

Notes 2. Delivered subject to conditions

(a) Installation and inspection i.e. goods are sold subject to installation,

inspection etc.: Revenue should normally not be recognised until the customer

accepts delivery and installation and inspection are complete. In some cases,

however, the installation process may be so simple in nature that it may be

appropriate to recognise the sale notwithstanding that installation is not yet

completed (e.g. installation of a factory-tested television receiver normally

only requires unpacking and connecting of power and antennae).

(b) On approval: Revenue should not be recognised until the goods have been

formally accepted by the buyer or the buyer has done an act adopting the

transaction or the time period for rejection has elapsed or where no time has

been fixed, a reasonable time has elapsed.

(c) Guaranteed sales i.e. delivery is made giving the buyer an unlimited right of

return: Recognition of revenue in such circumstances will depend on the

substance of the agreement. In the case of retail sales, offering a guarantee of

“money back if not completely satisfied”, it may be appropriate to recognise

the sale but to make a suitable provision for returns based on previous

experience. In other cases, the substance of the agreement may amount to a

sale on consignment, in which case it should be treated as indicated below.

(d) Consignment sales i.e. a delivery is made whereby the recipient undertakes to

sell the goods on behalf of the consignor: Revenue should not be recognised

until the goods are sold to a third party.

(e) Cash on delivery sales: Revenue should not be recognised until cash is received

by the seller or his agent.

3. Sales where the purchaser makes a series of instalment payments to the seller, and

the seller delivers the goods only when the final payment is received: Revenue from

such sales should not be recognised until goods are delivered. However, when

experience indicates that most such sales have been consummated, revenue may be

recognised when a significant deposit is received.

4. Special order and shipments i.e. where payment (or partial payment) is received for

goods not presently held in stock e.g. the stock is still to be manufactured or is to be

delivered directly to the customer from a third party.

Revenue from such sales should not be recognised until goods are manufactured,

identified and ready for delivery to the buyer by the third party.

5. Sale/repurchase agreements i.e. where seller concurrently agrees to repurchase the

same goods at a later date.

For such transactions, that are in substance a financing agreement, the resulting cash

inflow is not revenue as defined and should not be recognised as revenue.

6. Sales to intermediate parties i.e. where goods are sold to distributors, dealers or

others for resale.

Revenue from such sales can generally be recognised if significant risks of ownership

have passed; however in some situations the buyer may, in substance, be an agent

and in such cases the sale should be treated as a consignment sale.

7. Subscriptions for publications: Revenue received or billed should be deferred and

recognised either on a straight line basis over time or, where the items delivered vary

Contd...

154 LOVELY PROFESSIONAL UNIVERSITY