Page 163 - DMGT104_FINANCIAL_ACCOUNTING

P. 163

Unit 8: Financial Statements

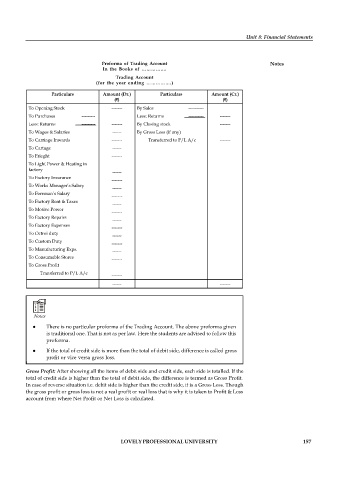

Proforma of Trading Account Notes

In the Books of …………….

Trading Account

(for the year ending …………….)

Particulars Amount (Dr.) Particulars Amount (Cr.)

( ) ( )

To Opening Stock ------- By Sales ----------

To Purchases --------- Less: Returns ---------- -------

Less: Returns --------- ------- By Closing stock -------

To Wages & Salaries ------ By Gross Loss (if any)

To Carriage Inwards ------- Transferred to P/L A/c -------

To Cartage ------

To Frieght -------

To Light Power & Heating in

factory

------

To Factory Insurance

-------

To Works Manager’s Salary

------

To Foreman’s Salary

-------

To Factory Rent & Taxes

------

To Motive Power

-------

To Factory Repairs

------

To Factory Expenses

-------

To Octroi duty

------

To Custom Duty

-------

To Manufacturing Exps.

------

To Consumable Stores

-------

To Gross Profit

Transferred to P/L A/c

-------

------ -------

Notes

There is no particular proforma of the Trading Account. The above proforma given

is traditional one. That is not as per law. Here the students are advised to follow this

proforma.

If the total of credit side is more than the total of debit side, difference is called gross

profit or vice versa gross loss.

Gross Profit: After showing all the items of debit side and credit side, each side is totalled. If the

total of credit side is higher than the total of debit side, the difference is termed as Gross Profit.

In case of reverse situation i.e. debit side is higher than the credit side, it is a Gross Loss. Though

the gross profit or gross loss is not a real profit or real loss that is why it is taken to Profit & Loss

account from where Net Profit or Net Loss is calculated.

LOVELY PROFESSIONAL UNIVERSITY 157