Page 165 - DMGT104_FINANCIAL_ACCOUNTING

P. 165

Unit 8: Financial Statements

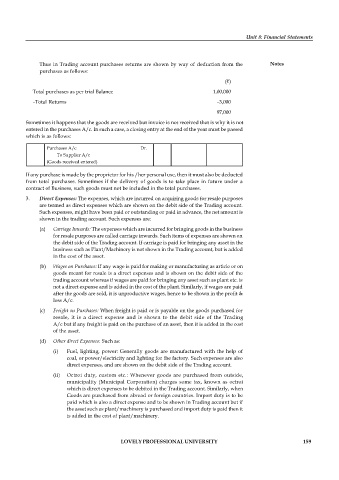

Thus in Trading account purchases returns are shown by way of deduction from the Notes

purchases as follows:

( )

Total purchases as per trial Balance 1,00,000

–Total Returns –3,000

97,000

Sometimes it happens that the goods are received but invoice is not received that is why it is not

entered in the purchases A/c. In such a case, a closing entry at the end of the year must be passed

which is as follows:

Purchases A/c Dr.

To Supplier A/c

(Goods received entered)

If any purchase is made by the proprietor for his /her personal use, then it must also be deducted

from total purchases. Sometimes if the delivery of goods is to take place in future under a

contract of Business, such goods must not be included in the total purchases.

3. Direct Expenses: The expenses, which are incurred on acquiring goods for resale purposes

are termed as direct expenses which are shown on the debit side of the Trading account.

Such expenses, might have been paid or outstanding or paid in advance, the net amount is

shown in the trading account. Such expenses are:

(a) Carriage Inwards: The expenses which are incurred for bringing goods in the business

for resale purposes are called carriage inwards. Such items of expenses are shown on

the debit side of the Trading account. If carriage is paid for bringing any asset in the

business such as Plant/Machinery is not shown in the Trading account, but is added

in the cost of the asset.

(b) Wages on Purchases: If any wage is paid for making or manufacturing as article or on

goods meant for resale is a direct expenses and is shown on the debit side of the

trading account whereas if wages are paid for bringing any asset such as plant etc. is

not a direct expense and is added in the cost of the plant. Similarly, if wages are paid

after the goods are sold, it is unproductive wages, hence to be shown in the profit &

loss A/c.

(c) Freight on Purchases: When freight is paid or is payable on the goods purchased for

resale, it is a direct expense and is shown to the debit side of the Trading

A/c but if any freight is paid on the purchase of an asset, then it is added in the cost

of the asset.

(d) Other direct Expenses: Such as:

(i) Fuel, lighting, power: Generally goods are manufactured with the help of

coal, or power/electricity and lighting for the factory. Such expenses are also

direct expenses, and are shown on the debit side of the Trading account.

(ii) Octroi duty, custom etc.: Whenever goods are purchased from outside,

municipality (Municipal Corporation) charges some tax, known as octroi

which is direct expenses to be debited in the Trading account. Similarly, when

Goods are purchased from abroad or foreign countries. Import duty is to be

paid which is also a direct expense and to be shown in Trading account but if

the asset such as plant/machinery is purchased and import duty is paid then it

is added in the cost of plant/machinery.

LOVELY PROFESSIONAL UNIVERSITY 159