Page 169 - DMGT104_FINANCIAL_ACCOUNTING

P. 169

Unit 8: Financial Statements

Notes

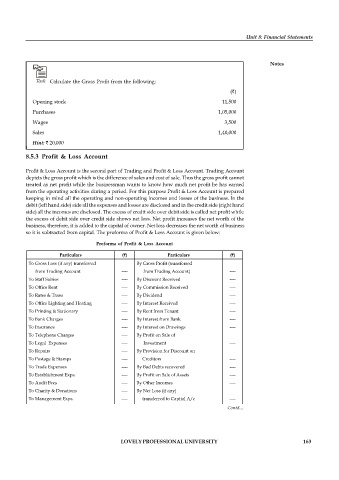

Task Calculate the Gross Profit from the following:

( )

Opening stock 11,500

Purchases 1,05,000

Wages 3,500

Sales 1,40,000

Hint: 20,000

8.5.3 Profit & Loss Account

Profit & Loss Account is the second part of Trading and Profit & Loss Account. Trading Account

depicts the gross profit which is the difference of sales and cost of sale. Thus the gross profit cannot

treated as net profit while the businessman wants to know how much net profit he has earned

from the operating activities during a period. For this purpose Profit & Loss Account is prepared

keeping in mind all the operating and non-operating incomes and losses of the business. In the

debit (left hand side) side all the expenses and losses are disclosed and in the credit side (right hand

side) all the incomes are disclosed. The excess of credit side over debit side is called net profit while

the excess of debit side over credit side shows net loss. Net profit increases the net worth of the

business, therefore, it is added to the capital of owner. Net loss decreases the net worth of business

so it is subtracted from capital. The proforma of Profit & Loss Account is given below:

Proforma of Profit & Loss Account

Particulars ( ) Particulars ( )

To Gross Loss (if any) transferred By Gross Profit (transferred

from Trading Account ---- from Trading Account) ----

To Staff Salries ---- By Discount Received ----

To Office Rent ---- By Commission Received ----

To Rates & Taxes ---- By Dividend ----

To Office Lighting and Heating ---- By Interest Received ----

To Printing & Stationary ---- By Rent from Tenant ----

To Bank Charges ---- By Interest from Bank ----

To Insurance ---- By Interest on Drawings ----

To Telephone Charges ---- By Profit on Sale of

To Legal Expenses ---- Investment ----

To Repairs ---- By Provision for Discount on

To Postage & Stamps ---- Creditors ----

To Trade Expenses ---- By Bad Debts recovered ----

To Establishment Exps. ---- By Profit on Sale of Assets ----

To Audit Fees ---- By Other Incomes ----

To Charity & Donations ---- By Net Loss (if any)

To Management Exps. ---- transferred to Capital A/c ----

To Depreciation on Contd...

Land & Buildings ----

Plant and Machinery ----

Furnitures ----

To Stable Expenses ----

LOVELY PROFESSIONAL UNIVERSITY 163

To Directors Fee ----

To Bank Charges ----

To Interest on Loan ----

To Interest on Capital ----

To Discount on B/R ----

To Sales Tax ----

To Advertisement ----

To Bad Debts ----

To Agents’ Commission ----

To Travelling Expenses ----

To Free Samples distributed ----

To Warehouse Expenses ----

To Packing Expenses ----

To Brokerage ----

To Distribution Expenses ----

To Delivery Van Expenses ----

To Provision for Bad and Doubtful ----

Debts ----

To Entertainment Expenses

To Carriage Cutward ----

To Loss on Sale of Assets ----

To Licence Fees ----

To Repairs of Assets & Motor Car ----

To Loss by Fire ----

To Conveynance Expenses ----

To Net Profit (Transferred to ----

Capital A/c.) ----

----

----- -----