Page 173 - DMGT104_FINANCIAL_ACCOUNTING

P. 173

Particulars ( ) Particulars ( )

To Purchases 20,000 By sales 30,000

-Returns 200 19,800 -Returns 500 29,500

To Wages 1,200 By Closing stock 7,500

To Gross Profit c/d 16,000

Unit 8: Financial Statements

37,000 By Gross profit b/d 37,000

To Salaries 900 16,000

To Travelling Expenses 700

Notes

To Commission 300

To Telephone 100

To Net Profit 14,000

16,000 16,000

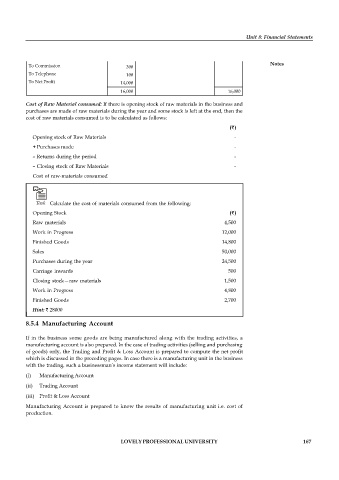

Cost of Raw Material consumed: If there is opening stock of raw materials in the business and

purchases are made of raw materials during the year and some stock is left at the end, then the

cost of raw materials consumed is to be calculated as follows:

( )

Opening stock of Raw Materials -

+ Purchases made -

– Returns during the period -

– Closing stock of Raw Materials -

Cost of raw-materials consumed

Task Calculate the cost of materials consumed from the following:

Opening Stock ( )

Raw materials 4,500

Work in Progress 12,000

Finished Goods 14,800

Sales 50,000

Purchases during the year 24,500

Carriage inwards 500

Closing stock—raw materials 1,500

Work in Progress 4,800

Finished Goods 2,700

Hint: 28000

8.5.4 Manufacturing Account

If in the business some goods are being manufactured along with the trading activities, a

manufacturing account is also prepared. In the case of trading activities (selling and purchasing

of goods) only, the Trading and Profit & Loss Account is prepared to compute the net profit

which is discussed in the preceding pages. In case there is a manufacturing unit in the business

with the trading, such a businessman’s income statement will include:

(i) Manufacturing Account

(ii) Trading Account

(iii) Profit & Loss Account

Manufacturing Account is prepared to know the results of manufacturing unit i.e. cost of

production.

LOVELY PROFESSIONAL UNIVERSITY 167