Page 172 - DMGT104_FINANCIAL_ACCOUNTING

P. 172

Gross Profit

2,50,000

Less

Office and administrative expenses

Salaries

Rent and taxes

26,500

Insurance charges

3,720

Audit fee

2,700

Printing and stationery

1,100

1,11,570

General expenses

550

Less

Selling and distributive expenses

1,210

4,000

-1,16,780

Carriage outwards

1,33,220

Advertising Particulars 77,000 ( ) 5,210 ( )

Operating profit

Add-

Non operating Income-

Interest on investments 4,300

Financial Accounting

Rent received 2,300

Profit on sale of Machinery 41,000 47,600 +47,600

Less 1,80,820

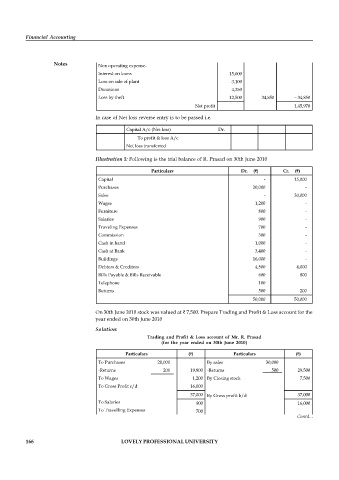

Notes Non operating expense-

Interest on loans 15,000

Loss on sale of plant 3,100

Donations 4,250

Loss by theft 12,500 34,850 – 34,850

Net profit 1,45,970

In case of Net loss reverse entry is to be passed i.e.

Capital A/c (Net loss) Dr.

To profit & loss A/c

Net loss transferred

Illustration 5: Following is the trial balance of R. Prasad on 30th June 2010

Particulars Dr. ( ) Cr. ( )

Capital - 15,000

Purchases 20,000 -

Sales - 30,000

Wages 1,200 -

Furniture 800 -

Salaries 900 -

Traveling Expenses 700 -

Commission 300 -

Cash in hand 1,000 -

Cash at Bank 3,400 -

Buildings 16,000 -

Debtors & Creditors 4,500 4,000

Bills Payable & Bills Receivable 600 800

Telephone 100

Returns 500 200

50,000 50,000

On 30th June 2010 stock was valued at 7,500. Prepare Trading and Profit & Loss account for the

year ended on 30th June 2010

Solution:

Trading and Profit & Loss account of Mr. R. Prasad

(for the year ended on 30th June 2010)

Particulars ( ) Particulars ( )

To Purchases 20,000 By sales 30,000

-Returns 200 19,800 -Returns 500 29,500

To Wages 1,200 By Closing stock 7,500

To Gross Profit c/d 16,000

37,000 By Gross profit b/d 37,000

To Salaries 900 16,000

To Travelling Expenses 700

To Commission 300 Contd...

To Telephone 100

To Net Profit 14,000

166 LOVELY PROFESSIONAL UNIVERSITY

16,000 16,000