Page 175 - DMGT104_FINANCIAL_ACCOUNTING

P. 175

Unit 8: Financial Statements

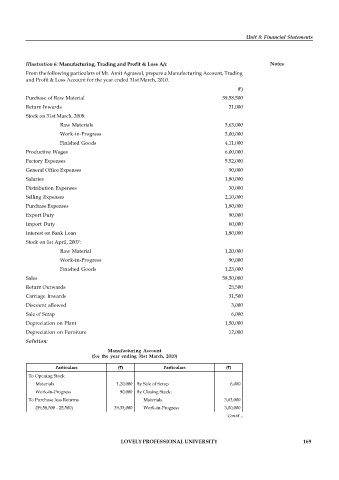

Illustration 6: Manufacturing, Trading and Profit & Loss A/c Notes

From the following particulars of Mr. Amit Agrawal, prepare a Manufacturing Account, Trading

and Profit & Loss Account for the year ended 31st March, 2010.

( )

Purchase of Raw Material 39,58,500

Return Inwards 21,000

Stock on 31st March, 2008:

Raw Materials 3,63,000

Work-in-Progress 3,00,000

Finished Goods 4,11,000

Productive Wages 6,00,000

Factory Expenses 5,52,000

General Office Expenses 90,000

Salaries 1,80,000

Distribution Expenses 30,000

Selling Expenses 2,10,000

Purchase Expenses 1,80,000

Export Duty 90,000

Import Duty 60,000

Interest on Bank Loan 1,80,000

Stock on 1st April, 2007:

Raw Material 1,20,000

Work-in-Progress 90,000

Finished Goods 1,23,000

Sales 58,50,000

Return Outwards 25,500

Carriage Inwards 31,500

Discount allowed 3,000

Sale of Scrap 6,000

Depreciation on Plant 1,50,000

Depreciation on Furniture 12,000

Solution:

Manufacturing Account

(for the year ending 31st March, 2010)

Particulars ( ) Particulars ( )

To Opening Stock

Materials 1,20,000 By Sale of Scrap 6,000

Work-in-Progress 90,000 By Closing Stock:

To Purchase less Returns Materials 3,63,000

(39,58,500 - 25,500) 39,33,000 Work-in-Progress 3,00,000

To Productive Wages 6,00,000 By Cost of Production Contd.. .

To Factory Exps. 5,52,000 (Transferred to Trading A/c) 50,76,000

To Purchase Exps. 1,80,000

To Import Duty 60,000

LOVELY PROFESSIONAL UNIVERSITY 169

To Carriage Inwards 30,000

To Depreciation on Plant 1,50,000

To Repairs to Machines 30,000

57,45,000 57,45,000

3