Page 171 - DMGT104_FINANCIAL_ACCOUNTING

P. 171

Unit 8: Financial Statements

Non operating expenses are such expenses which are incidental or indirect to the main operations Notes

of the business. Such expenses are interest on loan, charities and donations, loss on sale of fixed

assets, loss due to theft, pilferage or loss by fire.

Non-operating income is receipt of interest, rent, dividend, profit on sale of fixed assets etc. Such

incomes are always added in order to compute net profit.

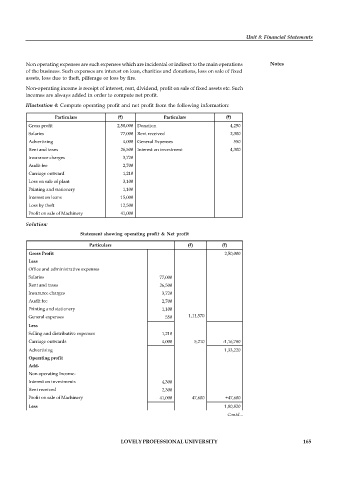

Illustration 4: Compute operating profit and net profit from the following information:

Particulars ( ) Particulars ( )

Gross profit 2,50,000 Donation 4,250

Salaries 77,000 Rent received 2,300

Advertizing 4,000 General Expenses 550

Rent and taxes 26,500 Interest on investment 4,300

Insurance charges 3,720

Audit fee 2,700

Carriage outward 1,210

Loss on sale of plant 3,100

Printing and stationery 1,100

Interest on loans 15,000

Loss by theft 12,500

Profit on sale of Machinery 41,000

Solution:

Statement showing operating profit & Net profit

Particulars ( ) ( )

Gross Profit 2,50,000

Less

Office and administrative expenses

Salaries 77,000

Rent and taxes 26,500

Insurance charges 3,720

Audit fee 2,700

Printing and stationery 1,100

General expenses 550 1,11,570

Less

Selling and distributive expenses 1,210

Carriage outwards 4,000 5,210 -1,16,780

Advertising 1,33,220

Operating profit

Add-

Non operating Income-

Interest on investments 4,300

Rent received 2,300

Profit on sale of Machinery 41,000 47,600 +47,600

Less 1,80,820

Non operating expense- Contd.. .

Interest on loans 15,000

Loss on sale of plant 3,100

Donations 4,250

LOVELY PROFESSIONAL UNIVERSITY 165

Loss by theft 12,500 34,850 – 34,850

Net profit 1,45,970