Page 183 - DMGT104_FINANCIAL_ACCOUNTING

P. 183

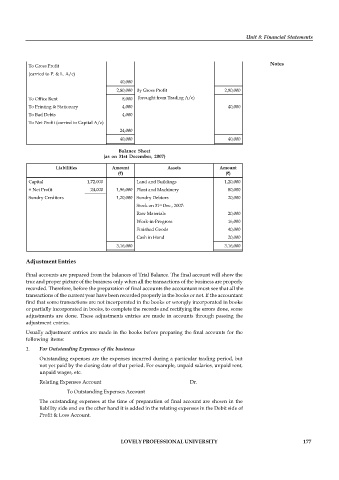

Particulars Amount Amount

( ) ( )

To Opening Stock: By Sales

Unit 8: Financial Statements

Finished Goods By Closing Stock 2,40,000

To Cost of Production 40,000 Finished Goods

(Transfer from Manufacturing A/c) 2,00,000 40,000

Notes

To Gross Profit

(carried to P. & L. A/c)

40,000

2,80,000 By Gross Profit 2,80,000

To Office Rent 8,000 (brought from Trading A/c)

To Printing & Stationary 4,000 40,000

To Bad Debts 4,000

To Net Profit (carried to Capital A/c)

24,000

40,000 40,000

Balance Sheet

(as on 31st December, 2007)

Liabilities Amount Assets Amount

( ) ( )

Capital 1,72,000 Land and Buildings 1,20,000

+ Net Profit 24,000 1,96,000 Plant and Machinery 80,000

Sundry Creditors 1,20,000 Sundry Debtors 20,000

Stock on 31 st Dec., 2007:

Raw Materials 20,000

Work-in-Progress 16,000

Finished Goods 40,000

Cash in Hand 20,000

3,16,000 3,16,000

Adjustment Entries

Final accounts are prepared from the balances of Trial Balance. The final account will show the

true and proper picture of the business only when all the transactions of the business are properly

recorded. Therefore, before the preparation of final accounts the accountant must see that all the

transactions of the current year have been recorded properly in the books or not. If the accountant

find that some transactions are not incorporated in the books or wrongly incorporated in books

or partially incorporated in books, to complete the records and rectifying the errors done, some

adjustments are done. These adjustments entries are made in accounts through passing the

adjustment entries.

Usually adjustment entries are made in the books before preparing the final accounts for the

following items:

1. For Outstanding Expenses of the business

Outstanding expenses are the expenses incurred during a particular trading period, but

not yet paid by the closing date of that period. For example, unpaid salaries, unpaid rent,

unpaid wages, etc.

Relating Expenses Account Dr.

To Outstanding Expenses Account

The outstanding expenses at the time of preparation of final account are shown in the

liability side and on the other hand it is added in the relating expenses in the Debit side of

Profit & Loss Account.

LOVELY PROFESSIONAL UNIVERSITY 177