Page 185 - DMGT104_FINANCIAL_ACCOUNTING

P. 185

Unit 8: Financial Statements

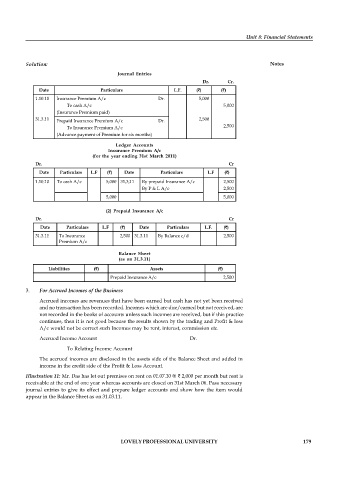

Solution: Notes

Journal Entries

Dr. Cr.

Date Particulars L.F. ( ) ( )

1.10.10 Insurance Premium A/c Dr. 5,000

To cash A/c 5,000

(Insurance Premium paid)

31.3.11 Prepaid Insurance Premium A/c Dr. 2,500

To Insurance Premium A/c 2,500

(Advance payment of Premium for six months)

Ledger Accounts

Insurance Premium A/c

(for the year ending 31st March 2011)

Dr. Cr

Date Particulars L.F ( ) Date Particulars L.F ( )

1.10.10 To cash A/c 5,000 31,3,11 By prepaid Insurance A/c 2,500

By P & L A/c 2,500

5,000 5,000

(2) Prepaid Insurance A/c

Dr. Cr

Date Particulars L.F ( ) Date Particulars L.F. ( )

31.3.11 To Insurance 2,500 31.3.11 By Balance c/d 2,500

Premium A/c

Balance Sheet

(as on 31.3.11)

Liabilities ( ) Assets ( )

Prepaid Insurance A/c 2,500

3. For Accrued Incomes of the Business

Accrued incomes are revenues that have been earned but cash has not yet been received

and no transaction has been recorded. Incomes which are due/earned but not received, are

not recorded in the books of accounts unless such incomes are received, but if this practice

continues, then it is not good because the results shown by the trading and Profit & loss

A/c would not be correct such Incomes may be rent, interest, commission etc.

Accrued Income Account Dr.

To Relating Income Account

The accrued incomes are disclosed in the assets side of the Balance Sheet and added in

income in the credit side of the Profit & Loss Account.

Illustration 11: Mr. Das has let out premises on rent on 01.07.10 @ 2,000 per month but rent is

receivable at the end of one year whereas accounts are closed on 31st March 06. Pass necessary

journal entries to give its effect and prepare ledger accounts and show how the item would

appear in the Balance Sheet as on 31.03.11.

LOVELY PROFESSIONAL UNIVERSITY 179