Page 188 - DMGT104_FINANCIAL_ACCOUNTING

P. 188

Financial Accounting

Notes 6. Interest on Capital and Drawings:

(i) For Interest on Capital

Interest on capital refers to the amount of interest allowed on the capital invested by

the proprietor in the business.

Interest on Capital Account Dr.

To Capital Account

Interest on Capital is added to the capital of owner in the liabilities side of the

Balance Sheet and disclosed in the debit side of the Trading and Profit & Loss Account.

(ii) For Interest on Drawings

Interest on drawings refers to the interest charged on the amount withdrawn by the

proprietor from his business for personal use.

Drawings Account Dr.

To Interest on Drawings Account

Interest on Drawings is subtracted from the amount of capital along with the

drawings and also shown in the credit side of income in Profit & Loss Account.

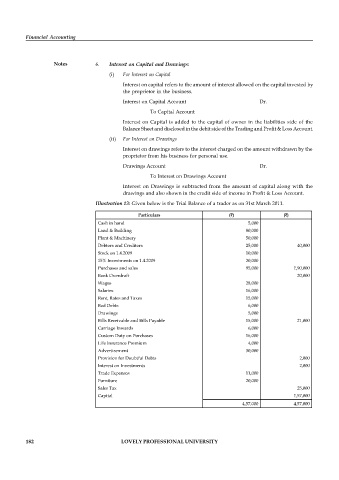

Illustration 13: Given below is the Trial Balance of a trader as on 31st March 2011.

Particulars ( ) ( )

Cash in hand 5,000

Land & Building 80,000

Plant & Machinery 50,000

Debtors and Creditors 25,000 40,000

Stock on 1.4.2009 10,000

15% Investments on 1.4.2009 20,000

Purchases and sales 95,000 1,90,000

Bank Overdraft 20,000

Wages 28,000

Salaries 16,000

Rent, Rates and Taxes 15,000

Bad Debts 6,000

Drawings 5,000

Bills Receivable and Bills Payable 15,000 21,000

Carriage Inwards 6,000

Custom Duty on Purchases 16,000

Life Insurance Premium 4,000

Advertisement 30,000

Provision for Doubtful Debts 2,000

Interest on Investments 2,000

Trade Expenses 11,000

Furniture 20,000

Sales Tax 25,000

Capital 1,57,000

4,57,000 4,57,000

182 LOVELY PROFESSIONAL UNIVERSITY